字體:小 中 大

字體:小 中 大 |

|

|

|

| 2010/06/07 17:53:38瀏覽11460|回應0|推薦2 | |

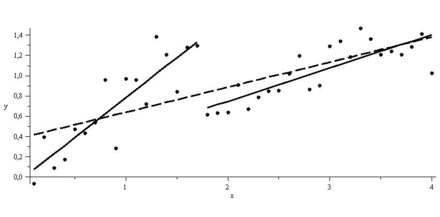

| 最近阿昇的論文裏面需要比較高多角化的廠商以及低多角化的廠商的統計迴歸式裏面的係數有無顯著差異,他顯然就卡在這裡找不到解決方法。 其實STATA裏面解決這樣的方法很多。最常見的方法就是CHOW TEST。CHOW test還是一個出身我國的知名的華人教授鄒至莊所訂下的檢定方法。1993年美国密西根大学“经济学俱乐部”评选的“29位伟大的经济学家”,他是唯一上榜的华裔学者,排名第8。 CHOW Test的好處在於可以驗證不同群體的參數,例如斜率與截距有無顯著差異。還可以在時間序列迴歸裏面驗證不同時間間隔是否出現結構性的變化。  If you are interested only in difference of intercepts, try a dummy variable regression model (fixed effect model). Suppose you suspect that the impact of salary on employees' motivation varies across companies; the slope of salary of one company is different from the slopes of other companies. For the sake of convenience, consider only two companies (d=1 or 0) here. size and culture are covariates. The pooled model, which assumes both companies have the same slopes and intercept, is: . regress motivation salary size culture You may fit separate regressions as follows: . regress motivation salary size culture if d==1 // for company 1 . regress motivation salary size culture if d==0 // for company 2 For the Chow Test, create an interaction term of the regressor salary and the dummy variable d, and then fit the model with the interaction and the dummy as follows: . gen salary_d = salary * d . regress motivation salary salary_d d size culture The coefficient of d is the deviation of the second company's intercept from the baseline intercept (d=0). Likewise, the coefficient of salary is the slope of the baseline company, and the coefficient of salary_d is the deviation of the comparison group's slope from the baseline slope. Now, conduct the Chow Test using the .test command. The null hypothesis is that two companies have equal parameters for salary and intercept; deviations of the slope and intercept are not statistically discernible from zero. . test _b[salary_d]=0, notest . test _b[d]=0, accum The notest option suppresses the output and accum tests a hypothesis jointly with a previously tested one. Rejection of the null hypothesis means that two companies do not share the same intercept and slope of salary. For more details about the Chow Test, see Stata's Chow tests

xtreg Y1 X1 X2 if group==1 est store eqn1 在迴歸式之後將係數儲存於EQN1 xtreg Y2 X1 X2 if group2==1 est store eqn2 在迴歸式之後將係數儲存於EQN2 再藉著SUEST來建立前面兩個迴歸式參數的共變異矩陣,結果如下: . suest eqn1 eqn2 Simultaneous results for eqn1, eqn2 Number of obs = 74 ------------------------------------------------------------------------------ | Robust | Coef. Std. Err. z P>|z| [95% Conf. Interval] -------------+---------------------------------------------------------------- eqn1_mean | trunk | 1.795019 .5414509 3.32 0.001 .7337943 2.856243 weight | .0198257 .0026465 7.49 0.000 .0146386 .0250128 _cons | 101.191 7.976745 12.69 0.000 85.55684 116.8251 -------------+---------------------------------------------------------------- eqn1_lnvar | _cons | 4.07378 .1992297 20.45 0.000 3.683297 4.464263 -------------+---------------------------------------------------------------- eqn2_mean | trunk | .3505976 .2067864 1.70 0.090 -.0546962 .7558915 weight | .0281942 .0013789 20.45 0.000 .0254916 .0308968 _cons | 99.5758 2.856284 34.86 0.000 93.97758 105.174 -------------+---------------------------------------------------------------- eqn2_lnvar | _cons | 3.192463 .1816868 17.57 0.000 2.836364 3.548563 ------------------------------------------------------------------------------ 接著就比較在模式一與模式二中的trunk變數的係數的平均 值有無顯著差異。Null Hypothesis是假定兩者相減為0. . test [eqn1_mean=eqn2_mean]: trunk ( 1) [eqn1_mean]trunk - [eqn2_mean]trunk = 0 chi2( 1) = 6.21 Prob > chi2 = 0.0127 有顯著差異,所以推翻虛無假設。兩者不相等。這樣就可以完工走人! compare coefficients from two models, stata, chow test, pool regression, interaction effect, structure break |

|

| ( 時事評論|財經 ) |