字體:小 中 大

字體:小 中 大 |

|

|

|

| 2017/01/06 13:31:23瀏覽83|回應0|推薦0 | |

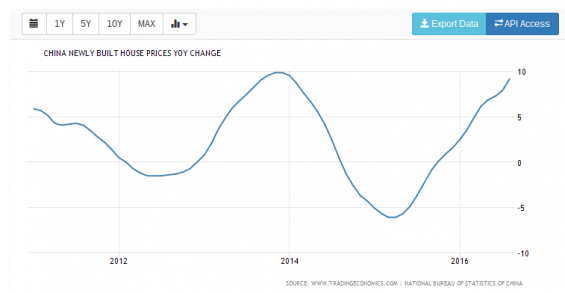

Chinese Real Estate Mogul: China’s housing bubble “Is the biggest bubble in history”Modern China is driven by central planning and a deeply crony culture. Interestingly the country has succeeded in reinflating its housing bubble. I say reinflate because about a year and a half ago things looked like they were really going to bust. (Thanks to the unsound monetary policy that created the initial unstable boom.) Then the government and the banks intervened (in typical central planner fashion) and we’re off to the races again. The government delayed the inevitable. But the debt monster lurks, even and perhaps especially in the red hot Shanghai real estate market.

The Chinese property bubble is not solely a Chinese problem. A real bust that unwinds quickly could have very destabilizing effects both on the global economic front and in geopolitics. |

|

| ( 不分類|不分類 ) |