字體:小 中 大

字體:小 中 大 |

|

|

|

| 2017/05/15 12:47:50瀏覽1172|回應0|推薦1 | |

Why China’s ‘One Belt, One Road’ plan is doomed to fail Eerie similarities with Japanese scheme 20 years ago suggests a future of white elephants, wasted money and corruption on a scale never seen before By Tom Holland 6 Aug 2016

Japanese prime minister Keizo Obuchi had a similar, ill-fated, idea to China’s One Belt, One Road in the 1990s. Photo: AFP Facing a deep slowdown after years of investment-fuelled growth that culminated in a huge property and stock market bubble, the leaders of Asia’s largest economy come up with a cunning plan. By launching an initiative to fund and construct infrastructure projects across Asia, they will kill four birds with one stone. They will generate enough demand abroad to keep their excess steel mills, cement plants and construction companies in business, so preserving jobs at home. They will tie neighbouring countries more closely into their own economic orbit, so enhancing both their hard and soft power around the region. They will further their long term plan to promote their own currency as an international alternative to the US dollar. And to finance it all, they will set up a new multi-lateral infrastructure bank, which will undermine the influence of the existing Washington-based institutions, with all their tedious insistence on transparency and best practice, by making more “culturally sensitive” soft loans. The result will be the regional hegemony they regard as their right as Asia’s leading economic and political power. If you think you’ve seen this movie before, you probably have. That could be an outline of China’s “One Belt, One Road” initiative, launched last year to great fanfare, and relentlessly promoted by loyal officials ever since. But it’s actually a description of a strikingly similar plan rolled out by Japanese prime minister Keizo Obuchi in the 1990s. That too promised to provide work for Japan’s recession-hit construction sector by building Japanese-funded infrastructure projects around Asia. And it even included a proposal – never realised – to establish an Asian Monetary Fund to lend to regional governments on easier terms than either the IMF or World Bank. Unfortunately for Beijing, the precedent is hardly encouraging. From the start the scheme was plagued by bickering over conditions and allegations of corruption. A handful of infrastructure projects did get built, but the reality fell woefully short of Tokyo’s grandiose dreams. Far from cementing Japan’s economic ascendancy across Asia, the project left a legacy of bad blood, and marked the beginning of a financial retreat from around the region that Japan has only recently begun to reverse.

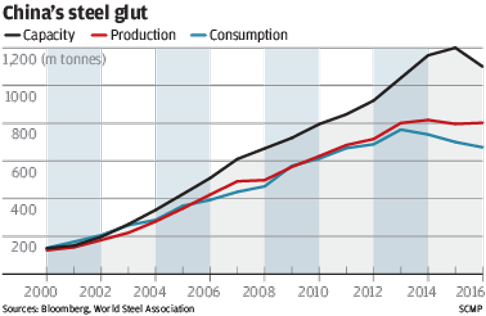

All the signs are that China’s One Belt, One Road plan will similarly fail in its main objectives. First, the idea that infrastructure projects in Central and South East Asia could absorb a sizeable portion of China’s excess industrial capacity is simply unrealistic. Consider steel. Currently China’s steel mills can turn out some 1.1 billion tonnes of the metal annually. Yet even with economic stimulus efforts in full swing, no one expects domestic demand to exceed 700 million tonnes this year. It is hard to imagine China building enough roads, ports and pipelines across Asia to use up the extra 300 million tonnes of capacity, especially when you consider that the World Steel Association forecasts demand in the European Union, the world’s largest economy, to be just 150 million tonnes this year. Beijing could try. But if it did, it would run into another problem. Asia needs infrastructure development, but the region’s capacity to absorb new projects is limited. As China has learned at home, building a new high speed rail line or state of the art airport is easy enough given plentiful funding. But building a high speed rail line that is economically viable is altogether more difficult. Inevitably, if Beijing attempts to pursue projects at a pace and in a number sufficient to make a dent in its excess capacity, it will end up building white elephants, wasting money, and encouraging corruption on a scale never before seen. These constraints mean China’s ambition of using lending tied to the One Belt, One Road initiative to help promote the yuan as Asia’s international currency of choice is also destined to fail. What policy-makers had in mind was something akin to the Marshall Plan, by which the United States pumped money into Western Europe in the late 1940s to fund post-war reconstruction, so confirming the US dollar’s position as the world’s dominant reserve currency. But 1940s Europe was very different from Central Asia today. Europe’s physical infrastructure may have been destroyed by war, but its know-how and institutional strength in depth were largely intact. Rebuilding on such foundations was relatively straightforward. Developing Asia’s foundations are still under construction. But while physical capital like a new port or railway can be built in just a few years, building the human and institutional capital that allow that port to operate efficiently and to contribute effectively to economic and social progress is a slower process. The two need to go hand in hand, which is why multi-lateral lenders like the World Bank lay such heavy stress on best practice. The senior officials charged with implementing China’s grand plan appreciate these capacity constraints, and appear to be scaling down their ambitions. That’s sensible, but it means the One Belt, One Road initiative will fall far short of its original objectives, just as its Japanese forerunner did almost 20 years ago.

|

|

| ( 創作|散文 ) |