字體:小 中 大

字體:小 中 大 |

|

|

|

| 2018/03/07 09:14:14瀏覽12|回應0|推薦0 | |

China’s financial regulatorsAll changeThe main supervisory agencies get a new set of bossesNov 5th 2011 | from the print edition Facing a tough task

THE grey men at the top of China’s main financial-regulatory agencies do not change often. So the appointment of new bosses to the agencies supervising the banking, securities and insurance industries has created a splash. The most important job, that atop the China Banking Regulatory Commission (CBRC), goes to Shang Fulin (pictured), a careful bureaucrat who most recently served as the chief securities regulator. His widely applauded reforms allowed illiquid shares of state-owned enterprises to be traded, as well as the introduction of index futures and margin trading. But Alicia Garcia-Herrero of BBVA, a Spanish bank, argues that he moved too slowly on bond-market reforms and fears that “this reduces the likelihood of interest-rate liberalisation and further opening up of the capital account any time soon.” In this section

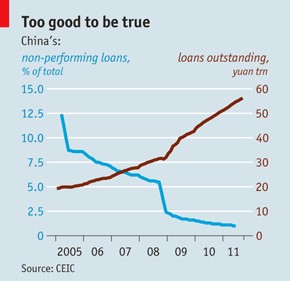

Mr Shang’s former job running the China Securities Regulatory Commission goes to Guo Shuqing, who until recently was chairman of China Construction Bank, a giant state-controlled bank. A fluent English speaker who spent time at Oxford, he is outspoken and seems market-minded: “If you don’t take any risk how can you make any money?” he asked in an interview with Reuters last year. Xiang Junbo, the former boss of the Agricultural Bank of China (ABC), another government-run banking goliath, is the new insurance regulator. He made his mark with the dual listing of ABC shares last year in Hong Kong and Shanghai, which at $22 billion was then the biggest public placement ever. The trio have a tough task ahead. They must overcome meddling from above as well as crises brewing below. Zhao Xinge of the China Europe International Business School observes that “CBRC clearly does not have total control in how the banks should be regulated.” He points to fresh demands from the country’s leaders that banks be “more tolerant” of bad loans made to small and medium enterprises, which, he quips, are “too many to fail”. That hints at another sort of trouble for Mr Shang and his colleagues. Ostensibly, China’s banks are in good health. Several publicly-listed state-controlled banks unveiled impressive third-quarter profits: Bank of China’s quarterly profits rose by 9% from a year ago, ABC saw a rise of 40% and China CITIC posted a 41% increase. The snag is that these profits may be built on a mountain of bad debt. Few analysts believe the government’s rosy figures on non-performing loans, given the lending binge that the big banks went on as part of China’s official stimulus policy (see chart). One concern is that the property bubble will burst. Another is the meltdown of the informal lending sector, which Credit Suisse estimates may be worth 4 trillion yuan ($629 billion). The main worry, however, is local-government debt. This week the CBRC hinted for the first time that it may allow the special investment vehicles holding most of this debt to delay loan payments. That would help ease an immediate crunch—but it would also further muddy the banks’ accounts and delay a proper clean-up of balance-sheets. Unless Mr Shang and his colleagues prove exceptionally deft, investors will be in for a rocky ride. from the print edition | Finance and economics

All change Nov 5th 2011, 17:35

For less than one month, China’s Communist Party (CCP), following the upcoming fifth generation, has changed the name of some heavy finance seat, shaking the world from industrial to financial consortium.

The last Saturday’s Bloomberg Businessweek, according to Reuters, reported that Agricultural Bank of China Ltd. Chairman Xiang Junbo as well as China Construction Bank Corp. Chairman Guo Shuqing resigned; on the other side, Liu Mingkang, chairman of the China Banking Regulatory Commission, may be replaced by China Securities Regulatory Commission Chairman Shang Fulin, and Jiang Jianqing, chairman of Industrial & Commercial Bank (ICBC) of China Ltd., is also a contender to head the banking regulator. The incumbent regulator is Wu Dingfu, the current head of the insurance regulator, having reached the compulsory retirement age of 65. As many people concerned of financial business know, ICBC and Construction Bank are the world’s two largest banks by market value, so this list is very important for the global finance and can infer how the fifth CCP exercises China’s economy.

China’s state-run company is also considered to adjust the list of big head-group. Liu Chuanzhi, the founder of Lenovo and once chosen as the most splendid businessman of CCTV, steps down as chairman with the brilliant historic number, 88 per cent rise compared with the same period last year and 35 per cent rise of the sales year-on-year to $7.8bn. Liu also reaches the compulsory retirement age of 65. The successor of chairman is CEO Yang Yuanqing, now aiming at the No. 1 PC maker Hewlett-Packard after surpassing Acer and Dell in PC world market share. The fifth CCP reshuffling seats of a series of state-run leaders may lead China to the new China 2.0; meanwhile, it must be the beginning point affecting many sides in the world from the product to the financial market.

At the present, Beijing gradually reshape China’s economical policy in order to steer China toward the next level of expanding inner economy, trying to show the willingness to be the No.1 world economy by 2020. But most of these figures, as I talk of in the above paragraph along with we see in this article, cannot let many enterprises and politicians in Europe, Japan and the United States see China as the advanced countries.

I have chatted with the “incumbent” Lenovo chairman Yang Yuanqing, discussing the possibilities of China’s vision and Taiwan’s financial surroundings. Yang mentioned the human resources of central government, including Zhou Xiaochuan (the President of People’s Bank) and Lin Yifu (a Taiwan-born economist and after 2007 becoming World Bank’s Asian Vice-President) while I was criticizing Peng Huai-Nang (the President of Taipei’s central bank). Moreover, Yang complained of the serious corruption and the strange bureaucratic culture. At that time, Yang and I referred to Shang and others. Indeed, Shang doesn’t do any better grade during Shang’s several previous work. Besides, only Guo Shuqing comes up with the international measure and has the ability to face the crisis of European debt. Mr. Guo does very good job during the tenure of China’s Construction Bank. And we both predicted that Xi Jin-Ping and Li Ke-Qiang would have arduous work of China’s financial market.

Wholly speaking, China’s bank system is growing stable and steady better than any other country in the world. By the way, in contrast of China’s bank, Taiwan’s Cathay Financial Group suffered the crisis of credit. The Cathay Group, led by Taiwan’s second richest Tsai Hung-Tu, faces difficulties in bussiness after Sony’s CEO & chairman Howard Stringer took money back two weeks ago while Kazuo Hirai was sure to succeed this waning bear Howard. Moreover, rumor has it that Citigroup has some dispute with the Cathay Group. In reality, Taiwan’s bank always terribly infects American Bank with bad credit record. The distance of structural quality between both sides of Taiwan Straits is sharply becoming longer.

Recommended 9 Report Permalink 這篇聊到商復林交棒給郭樹清的一些相關猜測及一年內中國混合經濟的作用,以官方控管面及生產導向而言這份任命更有活力,郭後來甚至擔任山東省委書記,在任上有儘量妥善協助處理陳光誠案。商雖然也是技術官僚出身,但傳統作風使其作為不多,金監會交由郭雖然只有一年多時間,但至今的措施完善,沒有多作變動就可使中國經濟成長率維持在接近7%的水平,就算期間遇到股災不只一次,國內金融面及秩序仍大致良好。另一方面,周小川的調控得當,這年又加上溫家寶總理的保八後續兩年2012-2013,每一季出台一次產業利多,如中小企業扶植計畫,及自貿區的招商辦理等等,經濟寬鬆又不失序,很高興筆者也有參與其中,鄉鎮銀行就有筆者的在地化點子和建議,就是台灣以前的農會信用合作社的變形。很順利的將中國經濟過渡給習李體制。 筆者有一併寫到台灣一小題,日本的索尼御殿山總部開始盤整財務的時候,有從台灣的國泰金控把投資全數撤出,因為台灣金融環境並沒有因陳雲林的措施而市場更自由而健全。筆者聽過後有對索尼產品重整就很有信心。在過幾篇的2012年2月的「Same old or new different?」該篇有所討論。 (2018,08,05補充)經濟學者雜誌對郭述清先生的政績卓著的評論,在2012年5月24日的當期有刊出,筆者在「Stimulus or not ? Jun 7th 2012, 16:49」附了一大段筆者還留著的文章做延伸,能為今日中國政經情勢有所警惕。 |

|

| ( 心情隨筆|心情日記 ) |