|

|

Gold Bull's view ? ! Gold Bull's view ? ! |

|

2018/04/15 06:54 |

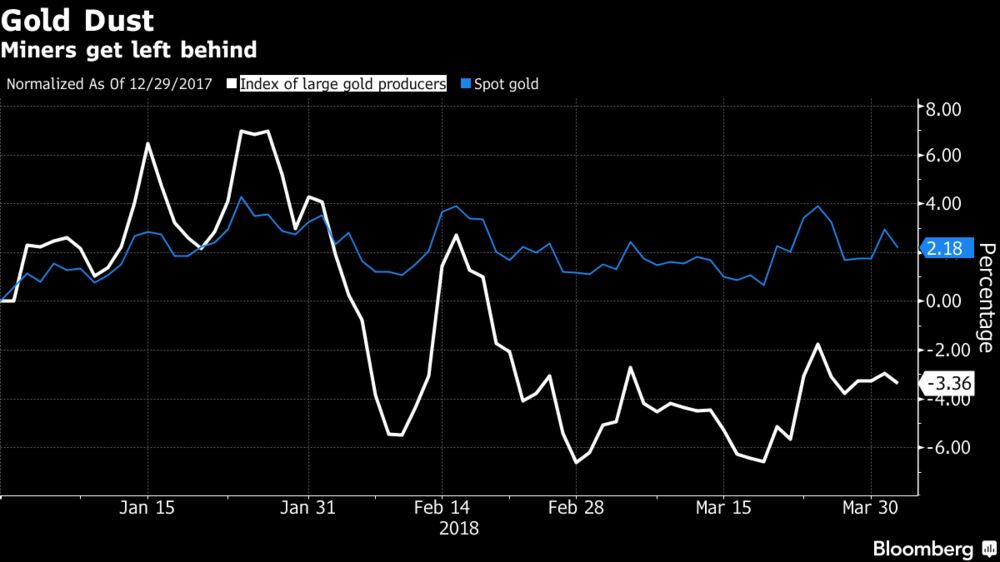

『The major miner ETF opened this week in the $22 region, which is the same level it was trading when gold was nearly $150 lower in late November of 2016. Most traders have given up and shifted speculative capital elswhere.

The GDX has been carving out a rounded bottom on the weekly chart. We have seen safe haven capital coming into the gold space while global geo-political tensions and monetary concerns have spooked investors.

The action in the GDX of late shows a potential bottom materializing out of boredom and neglect. When enough money has exited the sector, there is not enough selling power left to drive down prices much further and the market creates an exhaustion bottom.

If we indeed have a bottom in place, once the GDX closes above the $25 level, it would confirm a breakout and potentially bring a massive amount of capital into the sector. The $25 region in the global miner ETF could be synonymous with major resistance at the $1365 level being closed above and held on a weekly basis in gold. This week, the critical resistance at $1365 was tested for the third time this year and would constitute a major breakout if/when it closes above this level. Any move above $1365 would likely target at least $1450 in Gold and the $31 region in the GDX.

The gold miner sector is so small relative to broader stock markets that even minor shifts in capital flows can drive enormous gains in a relatively short amount of time. A long-term consolidation in the tight range of $21 to $25 in the GDX has now entered its 16th month, making the miner sector a coiled spring and ready to explode higher once the market is convinced the $1365 level in gold will become the new floor, as opposed to critical resistance.』 ~ David Erfle

懇請不吝賜教? |

|

摸 象 或 (不?) 著 木目(mbr8879576) 於 2018-04-15 07:29 回覆: |

|

|

『There are two opposite kindergarden games. Both plays the imbalance of demand and supply. One called musical chair ← the number of kids is one more than the number of seats. When the music stops, every kids are fighting for a seat to sit. The other game called Whirlwind 大風吹. Kids sit around a circle and passing a doll. When the music stops, the one end up holding the doll is the loser. These two game is resemble the gold miners stock markets. Lately the games are changing from the whilwind game to the music chair game. 』 The squeeze is coming ? !

|

|

|

|

|

Insider buying ? ! Insider buying ? ! |

|

2018/03/17 09:58 |

|

『... the gold stocks continue to languish in boredom and obscurity, the smart money will continue buying the quality miners which are being sold at discount levels due to lack of patience and growing disgust. Earlier this week, John L. Thornton, Executive Chairman of the largest gold mining company in the world, Barrick Gold Corp. (ABX), purchased over $3.5 million of ABX in the open market. Barrick’s share price has been cut in half since mid-2016 and is trying to bottom around the price Mr. Thornton just paid. When a sector bellwether like ABX makes a solid bottom, the confirmation of a GDX long-term bottom may not be too far behind. In fact, back in 2015, it was one of the first miners to bottom well ahead of the sector.』

http://www.kitco.com/commentaries/2018-03-16/Never-Sell-a-Dull-Market-All-Eyes-on-the-FOMC-Next-Week.html

懇請不吝賜教? |

|

摸 象 或 (不?) 著 木目(mbr8879576) 於 2018-03-28 07:58 回覆: |

|

A full list of each insider buy can be found at CanadianInsider.com. Here are a few of the main purchases.

- On March 12, Kevin Dushnisky, director and president, bought 4,310 shares at $15.47 per share. Dushnisky also bought 2,865 shares at $15.83 on March 13, 980 shares at $15.82 on March 13, and 3,845 shares at $15.92 on March 14. He currently owns 126,479 shares, according to filings.

- On March 12, Graham Clow, director, bought 4,000 shares at $15.49 per share, worth $61,960.

- On March 12, Robert Krcmarov, executive VP of exploration and growth, bought 2,000 shares at $15.46.

- On March 12, John Prichard, director, bought 10,000 shares at $15.41 per share, worth $154,100.

- On March 8, John Lawson Thornton, executive chairman of the board, bought 306,000 shares at $11.72, worth $4.63 million, and he now owns over 1.7 million shares of Barrick.

- On March 1, Pablo Marcet, director bought 1,000 shares of Barrick at $15.04, and on Feb. 23, he bought 4,000 shares at $15.68.

$$$.$$ must be in Canadian $

|

|

摸 象 或 (不?) 著 木目(mbr8879576) 於 2018-03-28 08:08 回覆: |

|

|

Most purchase price must be in Canadian $. Some may be in US $

|

|

|

字體:小 中 大

字體:小 中 大