字體:小 中 大

字體:小 中 大 |

|

|

|

| 2018/04/06 01:05:06瀏覽40|回應0|推薦0 | |

|

Economic forecasting Wanna bet?Mar 31st 2012, 9:58 by The Economist online Will the Chinese economy surpass Americas before the end of this decade? Michael Pettis, a professor at Peking University who has long been bearish on the Chinese economy, has betThe Economistthat it wont. Our Free Exchange blog has taken up the bet and countered with another: that Chinese GDP will grow faster than Mr Pettiss prediction of an average 3% a year this decade. What do you think? *參考該名網友資料: ============= Connect The DotsMarch 31st, 15:36 When will the Chinese GDP surpass America? · Recommend (8) · Report ================ Wanna bet? Apr 3rd 2012, 09:26

From the first visit to China in 1972, Richard M. Nixon with Henry Kissinger, well-prepared for the restoration of China-U.S. relationship, would like to improve the bilateral trade when China’s economy was hampered in the process of Chinese Cultural Revolution. Facing the desolation in China, the symbol of ties, such as ping-pong diplomatic, was more than the essentially economic activities. Yet, very earliy passionate, America foresaw the vision of Chinese next prosperity for the gross advantages behind the diplomatic and economic normalization

It takes more than one generation to recover Chinese economy from the decline after the mark of The Third Plenary Session of 11th Central committee of China’s Communist Party. Then, China’s formation of modern economy built up depending on the decision in Bashan-ron meeting. In 1989, China’s GDP already surpassed Taiwan’s; furthermore, Beijing first held the annual meeting of Asian Development Bank (ADB) ensuring the generator of world economy’s role. Although there was an incident of June-fourth Tienanmen Square, Foreign Direct Investment (FDI) had increased rapidly constantly until last year.

In 1997, Beijing abolished laws that restricted imports and exports by foeign-owned companies in China, leading to the second period’s accretion of FDI’s acceleration. The law, mainly pushed forward by then prime minister Zhu Rong-ji, had the world clearly see “who China really is” with Disney Mulan’s “Reflection” MV background in Yiheyuan (Beijing Summer Palace). The song, played by Christina Aguilera, reflected Zhu’s ambition to embrace the world economy tightly in expectation of all American for the advanced relationship:

(the last paragraph) “Why must we all conceal What we think, how we feel? Must there be a secret me Im forced to hide? I wont pretend that Im Someone else for all time When will my reflection show Who I am inside?”

Still in 2000, when Taiwan’s alteration of party occurred, the gross economy of Taiwan is nearly equal to that of Yangtze River’s south plus Pearl River’s surroundings in China. The talks of Chinese rise in the world had wide range from politics to traditional culture. Besides, the argument of whether China threatens or peacefully rises up has been prevailing. Meanwhile, there were so many foreigners, especially American, wondering about the myth of China or potentially Chinese surprise in the world.

Another background, “Crouching Tiger, Hidden Dragon”, showed the beautifully classical sensation satisfying numerous curiosity about China’s tiny and huge, following more foreigner focuses on this waking dragon. This movie let Lee Ang win the reputation in America with Oscar’s Gold. Today, I, one more time, listen to this prologue expressed by Coco Lee (Lee Wen) still continue my endless exclamation of Chinese recovery, not because of Coco Lee’s DJ ability in Taipei’s Police Radio Company at my age of less than 10 but the impression on Chinese art in this prominent movie.

(the last paragraph) “I tear and also sleep in the moonlight without regrets, just waiting for the true lover having me wake up with a kiss. I spend one day falling into the sleeping dream and moreover exercising one-year remembrance, saying you love me. I sleep deeply for love forever, as promised”

Deducing Chinese economy from statistics for two decades and experiencing the process of Beijing Olympic Game, nowadays China’s GDP reaches USD. 8130bn and the preview of 7.5% growth while America gets USD. 15604bn and 1.3% growth. Given the approximate 1.1% for American growth and 7.5% for China (pessimistic for China and optimistic for America) last for ten years, we can get respectively 17407.9bn and 16756.2bn about 2022-2023. That is to say, before the end of this decade, this question’s answer is “No”. And 12 years later, about 2024 China’s macroeconomics, GDP 19363.9bn, can wholly surpass America’s 17793bn. The answer is “Yes” when it comes to PPP for the occurrence is about 2018-2019. Indeed, China is already the biggest buyer in the world.

Using certain measurement to say, Guangdong’s economy surpassed Taiwan’s in 2011’s early summer. After last July China’s economy had overtook Japan, China was processing the industrial structure changes and financial adjustment. Adding to the rearrangement of Beijing’s leading core of China’ Communist Party, I adamently conclude that the soft-landing is inclined to happen with smoothly going forward.

Recommended 17 Report Permalink 附上一篇歌詞: 李玟 月光愛人 (國語) ([臥虎藏龍] 主題曲) LYRICS作詞:易家揚 ===================== 中國的經濟發展在千禧年之際,當時身為全球第六大經濟體及作為開發中國家第一大貢獻全球經濟的地區,中國的總體發展有目共睹。而就地緣政治觀點而言就是比較中國與美國的經濟成長數據面啦。筆者隨經濟學人的國際主義及自由主義,與些許理性主義來看中國於胡錦濤第一任將屆時,北京奧運舉辦之際被經濟學人稱為「凱因斯博士」,在溫家寶前總理喊出「保八」之後在這個網站討論區及智庫Economist Intelligence Unit有一系列的辯論。筆者就回至尼克森總統訪華時,中國大陸仍在文化大革命困境中,百廢待舉,而美國與中國中共建交的原因,其中之一就是看上中國對世界經濟仍具潛力,有友好的前景以及和當年蘇聯政府相益趣的共產主義觀點,是稍具開明面及有願遵守較親美的國際規則的務實面。在這前提下有了中美三個建交公報。 在習近平的兩個月前臨時將中共第十九大三中會議提前,變成一邊鞏固第二任及其後的政治權威,形成新的慣例,謂之「不忘初心」即毛澤東的翻版語再現。之前的三中全會,幾乎有作出未來五年經濟政策的指示,並且在每次的五年計畫中具體表現出來。 算有回應原經濟學人該篇的話,是根據2014年IMF的調查及報告,在140年後中國經濟以PPP=1.76兆美元,購買力平價而言超越了美國的1.74兆美元,重回了最影響世界市場的龍頭寶座。然就GDP而言中國當年僅有1.03兆美元,約為美國的六成。筆者在當時曾經對GDP作粗略預測,大略以對中國悲觀取成長最小理性猜測值,對美國經濟樂觀成長最大理性猜測值,當時筆者猜是要到了2022-23之際「we can get respectively 17407.9bn and 16756.2bn about 2022-2023」,不過當時還是叫做稍樂觀7.5%跟稍悲觀的1.1%,因為後來習近平傾向意識型態治國及反貪打腐,成長率變低而川普的當選使美國保守及保護主義恢復,因此GDP方面美國會比較晚才會被中國超越,大約是2027-28之時,難怪習近平要提「2025中國製造」的概念和想延任至這種事發生,而不想管國內是否有新的阿拉伯之春的事。 回顧起中國改革開放,在巴山輪會議之後,按筆者的考據就中國經濟而言第一個里程碑就是超越了台灣的GDP在1988年,而以人民幣計算是第一年過兆元,因此亞洲開發銀行的年會選在北京開議格外對中國來說很富意義,當時是1989年5月楊尚昆及鄧小平款待所有會員國(見周玉寇在美麗島電子報一文:張志軍來台日,回想當年郭婉容在人民大會堂,2014年6月26日)包括李登輝所指定的台北代表團長財政部長郭婉容女士。儘管不久後有六四天安門事件,這仍然沒有擋住當年創FDI外國直接投資額成長的歷史新高紀錄。「台灣的GDP/中國大陸的GDP」的比值此後一直拉開,沒有再回頭過。 1992年春時鄧小平進行南巡,雖被預估景氣過熱,但有宏觀經濟的調控方案出台,在1997年第二季的消費者物價上漲率只剩下2%,在調控得當後出口成長又變成縮小。1981-97年的年經濟成長率約為10%左右,而1997年除了香港主權回歸,中國的美國的邦交在這年恢復正常,江澤民在六四事件後以國家領導身份是第一次訪問美國總統柯林頓。另外,就是一場迪士尼電影「花木蘭」拍攝,由之後拿了六個Grammy獎和八次冠軍單曲的Christina Maria Aguilera在在頤和園的拍攝電影原聲帶的最後一首的 Reflection (Pop Version),那天拍攝朱鎔基還抽了空陪江澤民看現場的工作情形,除了是整修頤和園後首週重新開放,也有意味要放鬆中國經濟管制,這些想法除了在逐步的政策,尤其是中美經貿談判以及推行中國大陸加入WTO的準備,也有顯示在中共第十五大三中全會上。 2000年當台灣政黨輪替換阿扁當總統而台灣經濟低迷時,中國大陸的長江中下游加珠江流域(不含港澳)算起來還有12-13個省份加起來的總和,台灣GDP剛破十兆新台幣,到了2007年時,經濟學人在夏天的Leader專欄發文(筆者回文的最後一段寫錯了,不是2011年),判斷廣東省的GDP產值已經贏了台灣本島者,台灣的GDP值是中國大陸的12.2%。此後江蘇、山東(2008年)和浙江和河南(筆者記得在此後還有發文一篇討論過各省經濟數據),今年(2018年)應該會有四川、湖北、河北、湖南各省的追趕。 如果算人均GDP,在所有省份中,臺灣仍排名第一。按2016年統計數字,臺灣人均GDP約為2.2萬美元。而在大陸所有省份中,只有天津人均GDP超過2萬美元,為20008美元,北京、上海分別以18471美元、17340美元列二、三位。福建以11657美元列第六,頭號經濟強省廣東則以11075美元排第七。總體來算,大陸去年人均GDP為8866美元,跟臺灣還有一定差距。(搜狐財經網:http://www.sohu.com/a/213878575_99957156,2017年12月的報導) 2000年之時臥虎藏龍風靡一時,筆者一時興起來自己也翻個譯,這篇寫的不是原聲帶的最後一首的英語原版歌詞。「我願為了愛沉睡到永遠~」這句李玟的扣人心弦一句傳遍海內外,當時筆者回憶起才國小四五年級晚上十點和秦夢群教授的錄音節目,人生有夢,逐夢踏實。當年(2012年)筆者對中共的經濟政策很有信心,在2015年人均約過8000美元時,筆者之後在這附近還作了一次評估,在眾讀者覺得連5%都不到,如東北各省連1%都有困難時仍然很有信心,挺在6.5-7%附近,現在的經濟政策會偏離理性面,就恨難說了。 (其它請見亞洲四小龍2000-14的經濟比較:http://kerwinhh.pixnet.net/blog/post/103875278-%E4%BA%9E%E6%B4%B2%E5%9B%9B%E5%B0%8F%E9%BE%8D-2000-2014-%E7%9A%84%E7%B6%93%E6%BF%9F%E8%A1%A8%E7%8F%BE) *附一篇同年4月28日亞洲經濟展望文章 Asian economic rankingsA game of leapfrogSouth Korea may soon be richer than JapanApr 28th 2012 | from the print edition

THE Tokyo Sky Tree, a broadcasting and observation tower that will officially open on May 22nd, is 634 metres high (2,080 feet), making it the tallest building in Asia. Is this Japan’s last bid to stay on top? For years, Japan was Asia’s richest and most powerful economy. It was the first Asian economy to industrialise, and the emerging Asian tigers—Hong Kong, Singapore, South Korea, Taiwan and later China—merely followed in its tracks. Now, however, Japan is steadily being overtaken. China’s economy is now bigger than Japan’s, but less noticed is the fact that Asia’s so-called newly industrialised economies (NIEs) are, one by one, becoming richer than Japan. Most economists reckon that the best way to compare living standards is to take GDP per person measured at purchasing-power parity (PPP), which adjusts for differences in the cost of living in each country. On this gauge, Japan was overtaken by Singapore in 1993, by Hong Kong in 1997 and by Taiwan in 2010. But the most humbling re-ranking will be when South Korea becomes richer than Japan. The latest forecasts from the IMF suggest that this could happen within five years (see chart). That would be a remarkable turnabout. In 1980 South Korea’s GDP per person was barely a quarter the level of Japan’s. In this section · »A game of leapfrog Calculated at market exchange rates, Japan’s per-head income is still higher than all the NIEs except Singapore. Yet Japan’s high prices, especially for housing and food, bring down the country’s true standard of living. PPPs are tricky to calculate and economists come up with different numbers, so the IMF’s figures are contentious. Some other yardsticks, such as car-ownership rates, still suggest that Japan has a comfortable lead over South Korea. But the trend is clear: the tigers are outpacing their teacher. *附一篇2月28日回顧中美關系的文章 China and the worldWhat a difference a decade makesFeb 28th 2012, 5:15 by T.P. | BEIJING

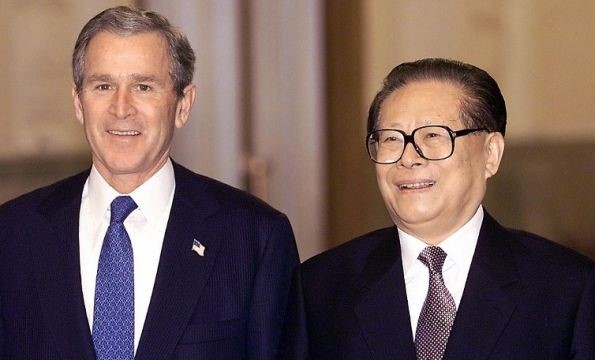

TEN years ago this month, while America was already starting to warm up its talk about regime change in Iraq, Chinas then-president, Jiang Zemin, fielded a question about the issue from an American reporter. With George Bush standing by his side in Beijing’s Great Hall of the People, Mr Jiang chose to cop out. “You asked about Iraq. The Iraq problem is relatively far away from us. But I think, as I made clear in my discussion with President Bush just now, the important thing is that peace is to be valued most.” That sort of bromide fit well enough with the principles that had long been at the core of Chinese foreign policy: a preference for steering clear of far-flung entanglements in order better to focus on growth and development at home; and a reluctance to endorse any country “interfering in the internal affairs” of another—lest anyone think about interfering in China’s. China had just joined the World Trade Organisation two months earlier, and was already on its way to a new and increasingly prominent role in the international community. It also imported 69m tonnes of oil that year. Mr Jiang delivered his reply to that reporter with a straight face in February 2002, but it was already stretching credulity to suggest that because of Beijing’s distance from Baghdad, he need not think too much about the looming crisis. Today China cannot even make such a pretence. For one thing, its oil imports have risen dramatically; they are projected to reach 266m tonnes this year. With such a dependency on foreign supplies, China cannot help but concern itself with the fate of the world’s oil-producing regions and the security of its own shipping routes. But oil is only one factor. As the world’s second-largest economy, China has seen its profile rise and its interests multiply. Growing engagement leaves China’s economy exposed to the winds buffeting other regions. Its people as more exposed too. There are now huge numbers of Chinese nationals living and working in hot spots around the world. The government had to evacuate more than 35,000 from Libya when that country slipped into turmoil last year. Together with China’s new and extensive involvement with the rest of the world comes a desire to exercise a greater degree of soft power, including the stronger assertion of Chinese interests in multilateral bodies. But there also comes the need to weigh in on issues that, in the past, China would have been able to keep comfortably at arm’s length. The controversy over Iran’s nuclear programme is a case in point. Countries including America, Israel and Saudi Arabia are urging China to adopt their hard line on Iran, which would be to the detriment of its considerable energy and commercial interests there. China is feeling similar pressure to take a firm stand on the increasingly chaotic situation in Syria. It is another sticky foreign-policy problem of the sort that China used to be able to sidestep. It no longer can, it seems, no matter how far away the trouble is. · 33 · inShare1 Related items

|

|

| ( 心情隨筆|心情日記 ) |