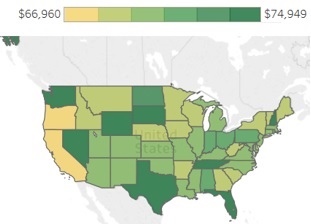

年薪10萬美金約新台幣306萬(月薪25.5萬)、人民幣69萬(月薪5.8萬),但扣完聯邦稅和州稅後還剩下多少?由於各州的稅率不同,能帶回家的薪水自然有所不同!

下面是能帶回家「最高」年薪的十個州:

(1) Florida ·········· $74,949

(2) Nevada ··········· $74,949

(3) New Hampshire ···· $74,949

(4) South Dakota ····· $74,949

(5) Tennessee ········ $74,949

(6) Texas ············ $74,949

(7) Washington ······· $74,949

(8) Wyoming ·········· $74,949

(9) Alaska ··········· $74,751

(10)North Dakota ····· $73,320

下面則是能帶回家「最低」年薪的十個州:

(1) Oregon ··········· $66,960

(2) California ······· $67,060

(3) Hawaii ··········· $67,349

(4) South Carolina ··· $68,306

(5) Minnesota ········ $68,404

(6) Maine ············ $68,599

(7) Wisconsin ········ $68,973

(8) Nebraska ········· $69,100

(9) Idaho ············ $69,114

(10)Arkansas ········· $69,141

如果再扣除城市稅、房屋(不動產)稅、房屋和汽車保險,總共約10%($10,000)左右,口袋還剩下多少呢?

字體:小 中 大

字體:小 中 大

字體:小 中 大

字體:小 中 大