|

|

|

|

|

Central Banks - sold Gold in August, 2020 Central Banks - sold Gold in August, 2020 |

|

2020/10/07 22:57 |

全球央行變成黃金「淨賣家」。 價格飆漲﹐導致需求減緩。 世界黃金協會(WGC)7日表示,全球央行8月﹐淨賣出12.3公噸的黃金。

https://udn.com/news/story/6811/4918156

The world’s central banks sold more gold in August than they bought, the World Gold Council (WGC) said on Wednesday, ending a year and a half-long run of monthly gold accumulation and helping stall a rapid rise in gold prices.

Gold surged from just over $1,500 at the start of 2019 to a record high of $2,072.50 in early August, before slipping to around $1,900.

Uzbekistan sold 31.7 tonnes, offsetting smaller purchases by countries including India, Kyrgyzstan and Turkey, the WGC said.

https://www.reuters.com/article/gold-central-banks/central-banks-sold-gold-in-august-as-price-rally-stalled-idINL8N2GY28I

懇請不吝賜教? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

July 2011 ~ July 2020 July 2011 ~ July 2020 |

|

2020/07/25 07:49 |

|

|

|

|

|

|

|

|

|

|

April 1st 2019 Bank of International Settlements ~ 黃金 與 美鈔 平起平坐。 April 1st 2019 Bank of International Settlements ~ 黃金 與 美鈔 平起平坐。 |

|

2020/07/07 14:09 |

On April 1st 2019, the Bank of International Settlements designated gold as part of its Basel III regulatory framework, a tier-1 ASSET CLASS. Up until then, it was considered a tier-3 asset, which qualifies for 50% collateral, whereas tier-1 assets (same as USD cash and U.S. Treasury bonds) qualify for 100% COLLATERAL.

月餘(2019五月底)﹐金價 結束 橫向整理﹐轉向上升﹐至今已滿13月﹐不見轉向契機。

表面看﹐導火線 乃中美貿易戰D.C. 談判破裂。 實際 可能 Covid-19 瘟疫。 也有可能 黃金 與 美鈔 平起平坐。成為 世界 央行 清帳貨幣。

https://kingdomecon.wordpress.com/2019/03/20/bis-to-reclassify-gold-as-a-tier-1-asset-on-march-31-2019-what-is-the-implication/

懇請不吝賜教? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

伯斯鑄幣廠黃金代幣(PMGT)。 伯斯鑄幣廠黃金代幣(PMGT)。 |

|

2019/10/20 20:20 |

利用智慧手機的便利性,毋須經過實物交易,非常簡單快速的購買一盎斯黃金。此為全球首見,因為每枚代幣都有實體黃金支持。這些黃金不僅有西澳省政府擔保,而且實際存放在位於伯斯的央行級金庫。

The Perth Mint Gold Token (PMGT) was launched by InfiniGold on Friday, and is backed 1:1 by GoldPass certificates issued by The Perth Mint. The digital certificates are 100% gold backed and guaranteed by the Government of Western Australia, which is the sole owner of the 120-year-old mint.

“PMGT is digitized gold that allows users to conveniently acquire and have entitlement over government guaranteed physical gold stored at The Perth Mint in a trusted and cost-effective way,” InfiniGold said in an announcement.

The token – designed with the assistance of professional services firm Ernst and Young – is aimed to offer an alternative to traditional gold investment products such as ETFs, while using blockchain tech to allow real-time trading and settlement.

InfiniGold CEO Andreas Ruf said: “With The Perth Mint as custodian of the underlying physical gold that backs PMGT, buyers will be able to access a secure and reliable token representing the strongest asset class to date – gold.”

The Perth Mint as custodian, the government of Western Australia has an AA1 rating from Moody’s.

懇請不吝賜教? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

新 金礦 日益 難找 ..... 新 金礦 日益 難找 ..... |

|

2018/05/03 07:46 |

Increase in gold exploration dollars spent not yet reflected in new discoveries。

http://www.miningweekly.com/article/increase-in-gold-exploration-dollars-spent-not-yet-reflected-in-new-discoveries-2018-05-02

A report from S&P shows. $54.3-billion has been allocated to gold exploration over the past decade, almost 60% higher than the $32.2-billion spent over the preceding 18-year period. However, the increase in dollars spent has not yet resulted in more new discoveries or discovered ounces compared with the previous period. Only 215.5-million ounces of gold has been defined in 41 discoveries over the most recent ten years, compared with 1.73-billion ounces in 222 discoveries in the preceding 18 years, the report notes. The total projected gold in discoveries from the past decade remains far below the amounts discovered prior to the 2008/9 financial crisis.” A major factor contributing to the lack of major discoveries is a shift in focus within the exploration sector. “While there is clearly a decline in discovered deposits and ounces, this will not impact the short-term project pipeline,” the report notes.

瞎摸象: New gold is getting more and more scarce. Gold miner is getting squeezed. Price of gold must be moving up just like collectables.

懇請不吝賜教? |

|

摸 象 或 (不?) 著 木目(mbr8879576) 於 2018-05-17 08:53 回覆: |

|

Goldcorp (GG -0.1%) Chairman Ian Telfer is the latest industry exec to predict the world has reached “peak gold,” saying that mine production will continue to decline because all the major deposits have been discovered. At US$1,300/oz. gold, we found it all. I don’t think there are any more mines out there, or nothing significant. And the exploration records indicate that," Telfer says.

Barrick Gold is "shrinking fast,” Telfer says. “We’re sort of going sideways. Newmont’s going sideways.”

GG's gold output has slipped since 2015 when it produced 3.4M oz., and has produced 2.8M oz. in 2016 and 2.5M oz. in 2017; ABX and NEM also have suffered declines from their peak production earlier this century.

|

|

|

|

|

|

|

|

How much gold is in the world? How much gold is in the world? |

|

2018/05/03 01:03 |

https://www.fool.com/investing/2018/04/30/who-are-the-biggest-gold-investors.aspx

The Word Gold Congress estimate that humans have pulled 187,200 tons of gold from the earth. If we melted the gold down and formed it into a cube, it would fit comfortably in the middle of a baseball diamond, which is 90 feet from base to base on each side. While relatively small in size, that cube would be worth a whopping $8 trillion at gold's recent price of around $1,340 an ounce. To further illustrate how rare and valuable gold is, the U.S. Geological Survey estimates that there are about 57,000 tons still in the ground to mine. Dig it up and melt it together, and the cube of additionally available gold would only stand as tall as an adult giraffe. Each year the mining industry digs out a little less than 3,500 tons of gold, or roughly 112 million ounces. Another 1,300 tons get recycled each year. Simple math tells that only 16+ years of gold mining left ? Meanwhile, another 1,300 tons get recycled each year. That puts the gold market at roughly $170 billion per year, which, for perspective, pales in comparison to the more than $1.7 trillion oil market. Jewelry industry uses an average of more than 2,000 tons of gold each year.

懇請不吝賜教? |

|

摸 象 或 (不?) 著 木目(mbr8879576) 於 2019-10-08 19:31 回覆: |

|

https://www.gold.org/about-gold/gold-supply/gold-mining/how-much-gold

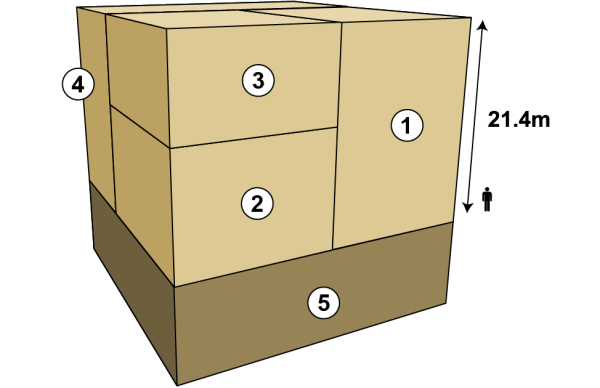

Total above ground stocks: 190,040 tonnes

1. Jewellery: 90,718 tonnes, 47.7%

2. Private investment: 40,035 tonnes, 21.1%

3. Official sector: 32,575 tonnes, 17.1%

4. Other: 26,711 tonnes, 14.1%

5. Below ground reserves: 54,000 tonnes

|

|

|

|

|

|

|

|

|

|

|

字體:小 中 大

字體:小 中 大

字體:小 中 大

字體:小 中 大