字體:小 中 大

字體:小 中 大 |

|

|

|

| 2018/04/06 01:17:23瀏覽144|回應0|推薦0 | |

HTCThe brand from nowhereAfter a swift rise from anonymity to omnipresence, the Taiwanese mobile-phone firm has stumbled. Time to get back on trackApr 7th 2012 | TAOYUAN | from the print edition

“IDEAS so simple”, reads a cartoon on an elevator door, “that they feel like the completion of a thought,” continues its twin. Similar doodles adorn the walls of HTC’s headquarters in Taoyuan, near Taipei, and business cards carried by the smartphone-maker’s staff. John Wang, the chief marketing officer, lays out a set of four: concentric circles with a smiley in the middle, denoting a focus on the customer; an arrow from A to B, for simplicity; a magnet, for “hidden power”; and a parcel, for “pleasant surprises”. Meaning what, in practice? Mr Wang shows off the camera in HTC’s new range of smartphones, the One series, which goes on sale this month. It is ready for use super-fast, focuses and shoots in a fifth of a second, takes photos in rapid succession and does away with cumbersome switching between stills and video: you can take snaps while filming or replaying. The engineering is hard, but hidden. The camera is easy to use. It is a pleasant surprise. In this section · »The brand from nowhere

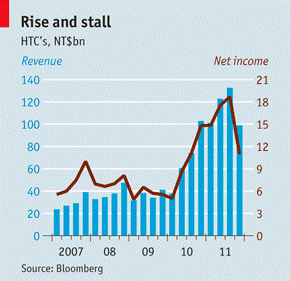

Last year, however, HTC produced an unpleasant one: sales and profits plummeted in the fourth quarter (see chart). In the first two months of 2012 revenue was a staggering 45% down on last year. In February Winston Yung, the chief financial officer, admitted that HTC had “dropped the ball”. Analysts mused that last year’s products were not its best: perhaps fast growth caused a loss of concentration. And the competition, from Apple’s iPhone 4S and Samsung’s Galaxy S2, was ferocious. Mobile-phone brands can flower and fade quickly. On March 29th Research In Motion, the Canadian maker of the BlackBerry, the latest to wilt, announced a quarterly loss, the departure of senior executives and a “comprehensive review”. No firm has bloomed as suddenly as HTC. Until 2006, when it started selling phones under its own name, it had no brand to speak of. Yet now only Apple and Samsung sell more “high-end” smartphones (costing $300 or more). In America it sold more smartphones than anybody else in the third quarter of 2011, according to Canalys, a research firm. This month two things will happen that HTC hopes will revive it. It will start selling a new crop of phones and step up its efforts in China, a market it entered only in July 2010. IDC, a research firm, says China will become the world’s biggest market for smartphones this year. Others reckon it already is. Founded in 1997, HTC began as one of many Taiwanese firms that design and make things that are sold under others’ brands—in its case, brands belonging to mobile-phone operators and computer-makers. In 2000 it produced the iPAQ, a personal digital assistant, for Compaq, a firm bought by Hewlett-Packard in 2002. HTC’s original name was High Tech Computer, which is as anonymous as it gets. It won a reputation for excellent engineering. But it wanted more, and began to invest more in innovation before eventually creating its own brand. It set up a unit called MAGIC Labs, which was charged with coming up with lots of ideas, even if most were quickly discarded. (Mr Wang was its “chief innovation wizard”. He still has a few of those business cards, too.) From this came, notably, the HTC Touch, a touch-screen device that appeared in 2007, at about the same time as Apple’s first iPhone. Mr Wang admits to feeling “terrible” when the iPhone appeared, but he says he soon felt “at ease”. Because “HTC had a very weak brand back then”, take-up of the new phones would have been slower had Apple not made touch-screens cool. Spectacular growth came hand in hand with that of Android, Google’s mobile operating system. HTC latched on to this early, making the first Android smartphones, despite an earlier tie-up with Microsoft. Like everyone else, it has caught shrapnel in the patent wars. In December America’s International Trade Commission ruled that some HTC devices had infringed an Apple patent and should be banned from America from April 19th. HTC says a redesign will deal with the objection. Patent wars may not have halted it, but it has stumbled nonetheless. Pierre Ferragu of Sanford C. Bernstein, an investment bank, links its decline to the “tyranny of the flagship”: the tendency for top-of-the-range phones to scoop a disproportionate share of the market. Mr Ferragu reckons that in the fourth quarter of 2011 30% of volume, 52% of sales and 87% of operating profits were accounted for by iPhones and Samsung’s Galaxy S2 alone. He expects these ratios to fall and thinks that HTC is best placed to gain. Mr Yung promised that growth would resume when new products appeared. There are reasons to be cheerful. The One phones were well received when HTC showed them off at Mobile World Congress, an industry jamboree, in Barcelona in February. Deals with 140 operators and distributors around the world should help get them into consumers’ hands. In China, explains Ray Yam, the head of HTC’s business there, the company started later than in richer parts of the word largely because the country’s mobile infrastructure was iffy. These days 10-15% of users have 3G, a figure expected to rise rapidly; and more people have access to Wi-Fi, in public places if not at home. HTC has taken about 10% of the market for smartphones costing more than 2,000 yuan (about $300). It is time for a further push. So HTC is launching its first national marketing campaign. It will also open many more “shops in shops”—booths run by manufacturers in electronics stores in which they jostle for custom. HTC has 2,300 so far; Mr Yam expects there to be 4,000 by the end of the year and 6,000-7,000 eventually. (He reckons Apple has 3,500 and that Nokia and Samsung have 9,000 each.) HTC is also introducing phones tailored for the Chinese market. Last month the Triumph, the first phone in China with the newest version of Windows, went on sale. Also coming is the Desire, which has the latest incarnation of Android and can switch between operators with incompatible standards. Here’s To China “This year is a very important one for HTC,” says Yan Siqing, chief operating officer of China Telling Telecom, which distributes around 15% of the country’s mobile phones. Mr Yan, whose firm works mainly with global brands, including HTC, says HTC grew rapidly in China last year, despite its late start, because it provided a “good user experience”. People know the brand and like the phones. “Its main competitor in [China] is Samsung. Apple is higher up and for now there’s no way to compete with them.” Nokia is another strong brand but its Windows phone is still new. That gives HTC “time for growth”. HTC has a good chance of bouncing back this year. Ben Wood of CCS Insight, a research firm, thinks it “has pulled it back with these new products”, but he adds that the firm is only as good as its latest device. The market changes fast. That means HTC will have to keep turning out hits. Others have seen it rise from anonymity to omnipresence and want to follow: Huawei and ZTE, two Chinese hopefuls, are far behind but hungry. HTC cannot yet rely on other sources of income: its tablet, the Flyer, has not yet flown. Apple, Samsung and the rest have alternative means of support. They also have many more billions to throw at marketing. HTC prefers to let its products do the talking. It seems confident that people will listen. from the print edition | Business 附所參考的PCWorld及Bloomberg相關報導 News New HTC phones offer high quality photo, audio featuresThe HTC One series represents the launch of a new strategy at HTCBy Nancy Gohring February 26, 2012 04:15 PM ET IDG News Service - HTC kicked off its new strategy of offering fewer but more differentiated phones in 2012 with the launch on Sunday of the HTC One series of phones, emphasizing high quality photo and audio technologies. The company made the announcement in Barcelona on the eve of Mobile World Congress, the largest mobile trade show of the year. The phones will be the first to come with ImageSense, technology developed by HTC that's designed to make the cameras in the phones as good as standalone cameras. ImageSense is a suite of camera features including one that lets a user launch the camera and take a shot in 0.7 seconds, said Peter Chou, HTC's CEO. The phones will also let users hold down the shutter button to take continuous photos and improve shots taken in low-light conditions, he said. · QuickPoll: What will be the biggest change to smartphones this year? · Broadcom readies chips optimized for Android 4.0 · Wi-Fi, small cells could disrupt mobile · Altair Semiconductor finds a place among mobile innovators · Nvidia expects to do well in Windows-on-ARM race · More smartphones are getting HD Voice · Microsoft shows Windows on ARM tablet designs · Windows on ARM will be 'huge,' exec says · Nokia aims to appeal to developers · Google once considered issuing currency ImageSense also has a neat feature that lets users take photos at the same time they are taking a video. It works by displaying an icon on the screen that users hit to take a photo while the video continues to record. With HTC's Media Link app, users can connect the HTC One phones via HDMI micro to any TV with an HDMI port to view photos and videos on TVs. "It does not force you to buy a special TV or lock you into one manufacturer," Chou said. That may have been a subtle dig at HTC competitor Sony, which earlier in the evening emphasized links between its TVs and its phones. HTC also announced a deal that gives HTC One buyers 25 GB of storage on Dropbox for two years. HTC has also added some new capabilities around music features of the phone. The HTC One is designed to let users connect the phone to their PC once to transfer music. After that, any time a user adds new music to their music folder on the PC, the content will automatically be wirelessly synched to the phone. Chou mentioned rival Apple several times. He showed side-by-side photos he claimed were taken by the HTC One and an iPhone that appeared to show better quality in the HTC photo. He also noted that users will be able to easily transfer music from iTunes to the HTC One. The high-end HTC One X runs on an Nvidia Tegra 3 quad-core processor, so HTX joins LG as the first to announce phones that use quad-core processors. In some markets, it will be available with an LTE-enabled Qualcomm Snapdragon S4 processor with up to 1.5 GHz dual-core CPUs. It has a 4.7- inch screen. The HTC One S is a lower end version in the series. It comes with a 1.5-Ghz dual-core Snapdragon S4 processor from Qualcomm and a 4.3-inch screen. It will offer the concurrent video and photo capture technology, fast camera startup and low light technology. The HTC One V is the third phone in the series. The company provided scant details of the phone except to say that it will use the same design as the HTC Legend. · QuickPoll: What will be the biggest change to smartphones this year? · Broadcom readies chips optimized for Android 4.0 · Wi-Fi, small cells could disrupt mobile · Altair Semiconductor finds a place among mobile innovators · Nvidia expects to do well in Windows-on-ARM race · More smartphones are getting HD Voice · Microsoft shows Windows on ARM tablet designs · Windows on ARM will be 'huge,' exec says · Nokia aims to appeal to developers · Google once considered issuing currency HTC said that 144 operators around the world plan to sell the phones starting in April. T-Mobile announced it would sell the HTC One S in the U.S. The new series demonstrates HTC's attempts to set itself apart from the competition, one analyst said. "The company lacks the resources to easily differentiate itself from rivals such as Sony, Samsung, and Apple in terms of value-added services, so its decision to focus on perfecting core smartphone functionality around camera and music playback is an extremely pragmatic one," said Tony Cripps, an analyst with Ovum, via e-mail. Nancy Gohring covers mobile phones and cloud computing for The IDG News Service. Follow Nancy on Twitter at @idgnancy. Nancy's e-mail address is Nancy_Gohring@idg.comHTC Profit Declines 70% After ‘Dropping the Ball’ on Phones Bloomberg News, sent from my Android phone

April 6 (Bloomberg) -- HTC Corp., Asia’s second-largest smartphone maker, posted its biggest drop in profit since listing a decade ago after sales declined amid competition from Apple Inc. and Samsung Electronics Co. First-quarter net income was NT$4.46 billion ($151 million), the Taoyuan, Taiwan-based company said in a statement on its website today, a 70 percent drop from a year earlier. The average of 17 analysts’ estimates compiled by Bloomberg was for profit of NT$4.62 billion. HTC “dropped the ball” on new products during the fourth quarter, Chief Financial Officer Winston Yung said in February, pushing inventories higher and prompting the company to forecast a “transitional” first quarter. “HTC’s sales growth for 2Q12 from a low base should exceed those for major competitors Apple and Samsung,” Dale Gai, who rates the stock equal weight, the equivalent of hold, at Barclays Plc in Taipei, wrote in an April 3 report. Revenue for the quarter dropped 35 percent to NT$67.8 billion, compared with the NT$71.1 billion average of 22 analysts’ estimates compiled by Bloomberg and HTC’s own February guidance of NT$65 billion to NT$70 billion. “We simply dropped the ball on products in the fourth quarter,” Yung said in a Feb. 6 conference call, where he described the first quarter as a transitional period and forecast a sales decline. “The form factor could be better and the product design could be better. So we’ve learned lessons from the fourth quarter products.” HTC shares climbed 2.8 percent to close at NT$585 in Taipei, before the announcement. HTC no longer provides shipment numbers, and is scheduled to update second-quarter guidance and discuss first-quarter results in a conference call to be held later this month. To contact the reporter on this story: Tim Culpan in Taipei at tculpan1@bloomberg.net To contact the editor responsible for this story: Anand Krishnamoorthy at anandk@bloomberg.net Find out more about Bloomberg for Android: http://m.bloomberg.com/Android ============================ 以下是回覆經濟學人的報導原作 The brand from nowhere Apr 9th 2012, 15:01

While opening the modern economic history of this island, after 1980s, Information Technologies (IT) or high-tech mainly steers the direction of Taiwan’s industrial development. The intensively capitalist along with brain-inclined enterprises flourish in Taiwan, especially in Hsinchu or Tainan, leading Taiwan’s industrial development to another transformation. Taiwan’s technology and skill are nearly equal to Japan’s and the industry has close tie with Japan’s. Rather than Japan’s business suffering, after 2008’s global financial crisis, Taiwan’s manufacturers damaged less and tried to make another chance like Hon-Hai which bought 10% Sharp’s share last month.

Along the sidewalk of Taiwan’s growing industry, numerous stories tell the world that the newly-industrialized economics (NIEs) build-up makes the advanced nation under pressure owing to the lower cost and highly efficient quality. The aggressive spirit of inhabitant, the original virtue making the past Taiwan stand at No.1 output - especially sugar, rice and tea leaves, resulted in this brilliant achievement dressing the Formosa. So does Taiwan’s industrial value of some brand nowadays in the world.

The prominent examples among manufacturers includes Hon-Hai’s Guo Tai-Min (Terry Guo), Acer’s Shih Zhen-Rong (Stan Shih) with Wang Zen-Tang, BenQ’s Li Quan-yau, Asus’ Shih Chong-Tang (Jonney Shih), Quanta’s Lin Bai-Li, RSMC’s Chang Zhong-Mou (Morris Chang), UMC’s Tsau Sin-Tsang with Shuan Min-Zhi and Giant Tu Show-Zhen (Bonnie Tu).

Very earlily and among these stories, the anecdotes and business’ principle from Wang Yong-Ching’s family are most talked and learnt by Taiwan’s every family. Until now, the Wang’s dynasty of Taiwan Formosa Plastic still be invincible in Taiwan; furthermore, Wang Shuei-Hung (Cherr Wang), Mr. Wang’s daughter, even became the Taiwanese richest last year.

The first that I impressed on her business is VIA Technologies, co-founded with the present husband Chen Wen-Chi in 1992. At the beginning, VIA, one of the sprouting electronic business, provided the integration system for small or medium business establishing automatic control. In 1997, Cherr Wang expanded her new territory into mobile devise by founding HTC, a tiny contract manufacturing outfit, and about 2005, HTC expressed the two “first” successful product - PPC6700 in 3G and HTC Universal with Microsoft’s system. Then, HTC Touch in 2007 and first Google Android’s T-Mobile G1 in 2008 ensured her leading place of mobile devise in the world. In the earlier years of Android, HTC was the closest with Google (now Motorola is) so, for the consumers - especially radical buyers of technology like me - HTC’s mobile phone is no question of the best choice.

It has been long time since HTC became the market-king in Taiwan Weighed Index shortly after the remark on HTC Hero, which first preloaded well-designed HTC Sense matching Android. I bought and became a user of HTC Legend nearly two years ago, highly praising the endurance and specific sense of touch. During the trend in Android, HTC is still the largest producer of Android and windows mobile system - and the only - having the ability to compete with i-Phone.

Crossing the 4G technique as HTC EVO 4G with Sprint in 2010, Cherr Wang constantly chases the next apex and advance in range of both hardware and software. 2012’s first-quarter of HTC’s net income was NT$4.46 billion ($151 million), which was posted on its website last Friday, a 70% drop from a year earlier. At the same date, HTC’s biggest competitor, Samsung, announced the rise to a quarterly record 5.8 trillion won ($5.1 billion, including non-mobile phone concerned) in the first three months in 2012, compared with 2.95 trillion won a year earlier. And Sony finished the buyout from Ericsson, intending to earn next glory.

Although there were some bad news from the producer of mobile phone last year, such as the nearly declining Nokia, some lawsuit among Samsung, HTC and Apple, the present hottest Android 4.0 Ice Cream Sandwich and moreover potential Android 5.0 Jelly Bean excited many producers’ progress. The climax of Android 4.0 happened in the recent Barcelona show in Mobile World Congress 2012 (MWC), where HTC’s CEO Peter Chou started the highlight of launch event as following:

http://www.youtube.com/watch?v=6npjTQVBpPE

From a peep at this show, HTC ONE series, whose processor (ONE X) owns the best “quad-core” 1.5GHz, caught every media’s eyes. According to IDG and PCWorld’s reports, there are more latest innovation produced by Asia's Sony, Samsung, LG, Huawei and America's Motorola, Blackberry showing off their limitation on challenge, like LG’s Optimus 4X HD, Sony’s Xperia P and U (S already unveiled in CES). Comparing with the strengthened HDMI for viewing media on TV, said by Peter Chou, Sony whose Xperia S owns 1200-pixel camera provides another choice for me. I might carefully consider my next Android Phone between HTC and Sony.

Recommended 5 Report Permalink 現在在市場的台灣手機,也是科技創新第一品牌的是宏達電。1997年5月由王永慶的女兒王雪紅創立後,2002年3月股票掛牌上市,2005年2月第一次當上股王,2006年4月是台灣第二支突破千元股票。2007年11月加入開放手機聯盟開始從原來偏Windows Phone的PDA手機研發製造及ODM代工生產轉型,並推出全球第一台Android 智慧型手機HTC Dream (G1)。2008年確立High Tech Computer Cooperation 縮為今天人們所熟知的HTC,隔年加入標語「quietly brilliant」。2011年3月因股票高漲使創辦人王雪紅,也是威盛電子合夥創辦人的她一度登上台灣首富,4月宏達電的股票達高點1300元一股,但一年內股票市值8800億元慘跌,到了2012年8月每股只剩240元。 六年前的2012年4月時,當時安卓4.0冰淇淋三明治剛問市,筆者買了一本聯經出版,由當時任中天新聞財經線主播張甄薇所編輯,王姐的第一本傳記:「王雪紅的故事:智慧型手機女王與她的IT王國」,這本第一頁先敘述接進2012年大選前三天,王姐找了一個牧師,和公司員工說對兩岸問題的看法及九二共識的支持。筆者有在此刻也回顧了台灣近三十年經濟成長,大部份是科技業所帶動經貿往來,而從代工王國到研發大國的歷程,當然這些實業主企業家的政治立場和投資取向也有影響到兩岸的政治關係發展。筆者當天回文有數了一下這些臉譜,而王永慶更是當年以經營之神著稱,反映在其語錄出版品上。而除了他的另一女兒王雪齡和女婿簡明仁的大眾電腦(FIC),這個女兒可說是曾經陪著第二波數位革命,讓人人有了新的手持數位通訊概念。宏達電也協助安卓從T Mobile G1 起及第一批,筆者在2009年7月在中華電信神腦門市及Sogo忠孝創始店鋪貨的的HTC Magic, Hero, Legend 到One及Desire系列的銷售開展,至今來到了Desire 12及U系列頂級規格的8GB RAM的 U12 Plus,確立了十多年作業系統領頭的要角。 HTC最大的特色對筆者來說是HTC Sense介面,和台灣上班族的需求較貼近符合中規中矩而又想有揮灑創意跟自我挑戰的成份,筆者常拿來和Sony、LG對照,三種牌子相較他牌比較符合台灣當地工作及生活需要,筆者對Samsung和Apple印象就是科技感重而已; Sony是給玩樂一族放輕鬆休閒用的,很講究螢幕呈現和聲光效果,重視軟體配置,LG是提供給基本教義派簡配,簡單的說是給小確幸小地方民眾的,科技便利融合在簡約生活,本來LG是C/P值最優的,只不過最近一年變得最貴而不太合理,相對來說就產品而言,HTC雖然在安卓4.4-5.1之間One M8到 One 10規格上劣勢,但後續的銷售成本較低,也有能力配備高規但價格多在新台幣兩萬左右以下,並靠著裁員瘦身,包括2015年的Era Program及2017年9月的11億美金的Google併購手機部門交易案(在Google脫手Motorola給中國聯想作海外品牌後)。 原篇回文在寫的時候,專利權的官司正在如火如荼進行。下面附上相關報導當年宏達電和蘋果、三星及微軟與邦諾書店的電子書專利問題,宏達電及至2012年11月才締結十年期的合約了事。在2011年之後,宏達電連年虧損,但年年均很夠衝勁突破,一年內推出Vive並宣稱要開拓VR虛擬實境市場,接著今月(2018年4月)宏碁宣佈大手筆跟進這塊及其他手機周邊市場。在一個月內要推出國際大廠們的第一台8GB RAM的安卓手機U12 PLUS,在性能和價格考量方面的確很值得期待,一台價格約在25,000-26,000元起跳,相較同價格的4GB RAM 的LG V30、五月即將問市的6GB RAM的LG G7 ThinQ有1000 nit這麼亮(應該有個新台幣24000-25000元)及6GB RAM的SONY Xperia XZ2,(就不在此比較最近變得比較高價的華為和三星)如果HTC這款沒有以往影像容易殘影或電池易膨漲,在有Hi-Res及杜比及混合自家研發Boomsound 的音效方面有下苦工這台,相信也是今年科技玩家很不錯的選擇。回憶起當年HTC EVO 系列標榜有3D螢幕體驗相比,這些高端手機看著這原來筆者該篇回文,真是大巫見小巫了。 回顧筆者從有了第一台智慧型手機HTC Legend的這八年多來,各家廠商從台灣、韓國、日本及中國大陸的白牌到紅牌與美國的幾間廠商興衰,筆者在這篇回文後,陸陸續續都有提過有提供安卓手機的各家優劣,從想敗部復活的索尼,早早把手機業務賣給富士通Fujitsu然後又把這條業務賣給幾乎同時併吞Motolora的聯想Lenovo的日本東芝公司Toshiba(Windows Phone部門,有保留安卓平板),到這篇HTC的衰落和轉戰奮鬥。中國大陸的小廠蛻變行列有在一開始時先以低價供應的小米Xiaomi,也提到了2014年開始的雙系統百元美金價的小平板來看OEM轉型成ODM是否成功,這些公司大部份總部在深圳,如在2012年第一台雙系統平版問市的ICOO艾蔻公司、2014年含WIN8.1 32bit+安卓4.4以上首發的酷比魔方Cube、台電科技Teclast、林志玲廣告代言過的昂達Onda、馳為Chuwi、藍魔Ramos、中柏Jumper和本來幫日本東芝代工的品鉑Pipo,到這兩三年的OPPO及VIVO與金星JXD、美圖手機Meitu、被併吞的酷派Coolpad及後來居上但爭議不斷的樂視Letv手機。小米明明就和華碩手機一樣危險,尤其是行動電源,很容易自燃引發電線走火,有的案例還比去年三星手機被公佈的糟透了。除了台灣奔騰Benten和從宏碁分家的明碁友達BenQ還有中低端手機夾縫中生存,鴻海集團有Infocus和前年併購的Sharp,蘋果公司也慢慢將手機代工業務慢慢移轉給和碩,這競爭不因為安卓的科技技術面安定而平息。也在安卓一開始問市後搶得契機的華為Huawei和中興ZTE的稍老牌大廠現在面臨美國因自身國家安全顧慮而進出市場受到限制,在三星於中國市場大幅衰落後,在手機暢銷排行榜上又即將有一波洗牌場面出現。 筆者使用的是Nokia Lumia 830(含sim卡的主機及當作Dolby音樂播放器)和Panasonic Eluga C(視頻播放和打電動機),用郭台銘的業務員概念滑手機的數位生活。Nokia Lumia 830是在微軟2017年7月終止Windows Phone 8.1服務的8月買的,正好就是三月初出事被告詐欺的捷運迴龍站旁的商家慧鑫通訊買的,這是香港公司貨也沒有功能問題,也沒有台灣公司貨只能充電到80%的怪問題(香港的電池充電有滿格),看上這台便宜才四折,支援128GB擴充能當作Walkman的替代品不錯,不過使用時要關wifi功能,讓4G LTE一直開著,冷光的時間提示真是滿足了筆者小確幸的心理。Panasonic Eluga C反映一向循著彼得定律的松下又故意一次要在市場不確定性低於一定程度之內才進場,看起來是懶豬研發但是很聰明地買斷了360 Qihoo的代工機,三年前4G RAM及安卓5.0就低於200元美金的低廉耐用,這台也是4GB RAM與安卓7.0有五千不到的價格還可以擴充到256GB記憶卡,P牌雖然以事業部門制,在科技管理學上遜於東芝集團及索尼但在買下Sanyo後的重整成果,在日本企業史也還沒淪落到只有小角色的戲份。在台韓及中國大陸的廠商與美國的蘋果公司及傳統微軟公司Microsoft及戴爾Dell、惠普HP爭奪夾殺下,日本的消費性電子產品的牌子和產值剩沒幾間如往日般響亮但還有後市可期。 筆者有之後數年內曾經以回文於經濟學人雜誌稍品頭論足一些手機的配置和企業管理面的問題,日後會慢慢貼出並回顧。 *附前月經濟學人提及HTC專利權訴訟問題: Patents and mobile devicesFRAND or foe?No sign of a ceasefire in the mobile industry’s intellectual-property warFeb 18th 2012 | from the print edition

A spot of bother over phones

GO AHEAD, but we’re watching you. That, in effect, is what competition authorities in America and the European Union told Google on February 13th. Last August the search-engine giant agreed to buy Motorola Mobility, a maker of mobile phones with 17,000 issued patents and 6,800 pending, for $12.5 billion. Neither America’s Department of Justice (DoJ) nor the European Commission has found a reason to halt the deal, but both tempered their approval with words of caution. The watchdogs sniffed the deal carefully because patents are powerful weapons and war is already being waged. This month Motorola Mobility won a court ruling in Germany to stop Apple selling several iPhones and iPads in its online store there; Apple managed to have the ban suspended. Microsoft and Apple have been firing regular volleys at devices that use Google’s Android operating system. At the International Trade Commission (ITC), a popular American venue for patent disputes, Microsoft is suing Barnes & Noble over the bookseller’s Nook e-reader. In April some Android phones made by Taiwan’s HTC are due to be barred from America, after a ruling in Apple’s favour by the ITC in December. In this section Google has hitherto been poorly armed, which helps explain why it is forking out $12.5 billion for Motorola Mobility’s arsenal. The protection this affords to Android should help the spread of the operating system, which according to Gartner, a research and consulting firm, powered just over half of all smartphones sold in the fourth quarter of 2011. Even so, Google’s purchase won less than wholehearted endorsement from American and European officials. A lot of Motorola Mobility’s patents cover technology needed to meet agreed industry standards that allow, say, phones to talk to networks. Once a standard is set, people have little choice but to use it. In theory, companies with “standard-essential” patents (SEPs) can charge exorbitant royalties, refuse licences or ask courts to ban unauthorised products. In practice they usually do not: in return for having their know-how built into standards, holders of SEPs are required by international standard-setting bodies to license it on “fair, reasonable and non-discriminatory” (FRAND) terms. Loads of companies use the technology of others, sometimes freely, sometimes for a fee or in cross-licensing agreements. But because FRAND is in the eye of the beholder, an owner of an SEP may still demand more than others think is fair for a licence, and spark hostilities. Although it let the Motorola deal go ahead, the DoJ compared Google unflatteringly with Apple and Microsoft. On the same day, it approved the picking of 6,000 patents from the carcass of Nortel Networks, a bankrupt Canadian equipment-maker, by a consortium that includes Apple and Microsoft, as well as Apple’s purchase of patents once owned by Novell, an American software company. The department said that short statements by Apple and Microsoft promising not to seek injunctions against products using SEPs had eased its concerns about possible damage to competition, but it called Google’s commitments “more ambiguous”. In a letter to the IEEE, a standards-setting organisation, on February 8th, Google said it would not go to court either—as long as licensees accept its terms. These include a maximum royalty of 2.25% of a final product’s price, before mobile operators’ subsidies; on a $500 phone, that makes $11.25. Joaquín Almunia, the EU’s competition commissioner, had already made his worries about the potential abuse of SEPs plain: last month he started an antitrust investigation into South Korea’s Samsung, which has been seeking injunctions against Apple in several countries. This week he restated his fears—and pointed out that his approval for the deal did not imply a blessing for whatever Google might do in the future. Googlesurely knew that: separately, Mr Almunia’s trustbusters have been examining complaints that the company abuses its dominant position in online search. Google looks like getting Motorola. But it may yet be got at. from the print edition | Business *附鴻海和夏普的開始洽談合併事宜在經濟學者雜誌首篇 Hon Hai and SharpCrystal visionA thriving Taiwanese electronics firm buys a slice of an ailing Japanese oneMar 31st 2012 | from the print edition

TAIWAN is home to a constellation of companies most people have never have heard of, making electronic gadgets and components for others with household names. The runaway success of one of these names, Apple, has made one of those Taiwanese suppliers, Hon Hai Precision Industry, the assembler of every iPad and most iPhones, less unfamiliar than the rest. On March 27th Hon Hai, which is also known as Foxconn, agreed to buy about 10% of Sharp, a struggling Japanese consumer-electronics company, for ¥66.9 billion ($808m). For a similar sum its chairman, Terry Gou, and other investors are buying half of Sharp’s 93% stake in a factory in Sakai, in Japan, that makes large liquid-crystal display (LCD) panels. As a symbol of the decline of Japan’s consumer-electronics industry and the rise of China’s (Hon Hai puts oodles of iPhones and iPads together at a huge complex in Shenzhen), the deal is hard to beat. Hon Hai has grown at an astonishing rate. This week it said it had hauled in more than NT$1 trillion ($33.8 billion) in revenue in the last three months of 2011, almost a quarter more than a year before. Its net income rose by 83%, to NT$35 billion. It has begun 2012 at a stupefying pace: in January and February its revenue was 50% higher than in the same period last year. This owes much to Hon Hai’s contracts with Apple, which have yielded vast profits (as well as criticism about working conditions) for both. In a recent report on Hon Hai, Kirk Yang of Barclays Capital estimates that this year the firm’s two business groups making things for Apple will contribute 39% of the overall company’s revenue, up from 34% in 2011. In this section · Apple In sad contrast Sharp, like the rest of Japan’s electronics industry, has gone blunt. It expects that in the year to March its revenue will fall by almost one-sixth, to ¥2.6 trillion, and that it will lose ¥290 billion. Most of its troubles can be explained by declining sales and prices of LCDs and LCD televisions, which account for something like 40% of its revenue. The Sakai factory, which opened in 2009, has been running at half its capacity. Alberto Moel of Sanford C. Bernstein, an investment bank, says that Mr Gou’s purchase values it at around a third of what it cost to build. If LCDs have become such a miserable business, why is Hon Hai so keen to get into it? On March 28th, indeed, it also promised to pump more equity into ChimeiInnolux, a lossmaking Taiwanese panel-maker of which the Hon Hai group owns 11%. It has already bought LCD television factories in Mexico and Slovakia from another Japanese company, Sony, which is now its main LCD customer. Hon Hai may think that, with its ruthless attention to costs, it can succeed where the Japanese have failed. Or it may see in Sharp and its Sakai factory, from which Hon Hai will eventually take half the output, the promise of a technological step up. Like other manufacturers in China, Hon Hai faces rising labour costs, though it is better placed than most. (Mr Yang reckons that labour accounts for only 4.5% of the cost of goods sold.) A move up the value chain may help. The deal may also be a hedge against Hon Hai’s most important customer: after all, there are lots of television and personal-computer brands that Hon Hai could supply with LCDs. Just as plausibly, however, Mr Gou is making a bet on its continued success. He may reckon that Apple will, as has long been rumoured, soon start making televisions—and that he and Hon Hai will profit again. from the print edition | Business |

|

| ( 心情隨筆|心情日記 ) |