字體:小 中 大

字體:小 中 大 |

|

|

|

| 2019/10/27 20:01:53瀏覽116|回應0|推薦0 | |

對於筆者這種會崇尚簡約生活和休閒工作平衡的來說,當然很希望不用那麼貴就能享受到科技的便利。所以一直以來,筆者對於蘋果是否過氣了?是很希望那一天的到來的。這顆就這樣的成為一種平淡的回憶,世界上的科技商品,在十一月的今天,於今年最後一次在數位走廊與山谷間落英繽紛於現在的秋季,深秋時節,尤其是剛剛聽過身為宏碁獨董的前行政院長張善政先生,前谷歌亞洲區硬體總監,能夠擔任車輪牌的副駕駛,兩個台灣的主要政黨都有推出以多元文化為底的科技夢,和蠻幹的某爛橘子相比,著實聽來悅耳。 從2007年1月更為今名的蘋果公司在換了今天的新址作為總部後,有個主要特徵是股價不是很穩定,但是產品線在十年間變得多元,在NASDAQ中,2018年11-12月間跌至美金150元過,而後升至最近的新高點美金263.14,每年固定一代的產品線會推陳出新,硬體基本上稍遜於安卓的高階機種,而較重軟體配置,但是像筆者想要的音效、等化器就沒有太突出(筆者當年很佩服HTC和SONY的音效,BEATS AUDIO和Walkman軟體BASS、CLEAR AUDIO和S-FORCE SURROUND,一瞥已經要七年多過了)。蘋果挹助大量的資金作為研發和投資,但是也利用軔體更新,淘汰的速度也很快。不可否認的,高消費和高回客率,讓蘋果十分有吸引力,但是利潤也因競爭劇烈,壓得很低(見原文第二張表格)。原文主要是拿三星和蘋果比較,當時三星在安卓仍然握有70-75%的市佔率,蘋果則出產同質性高的產品,比如三星的SMART TV和蘋果的iTV比較,在全球網路電視界開出了第一個煙硝味。亞洲各國的科技公司仍競相在當年正從紅海而趨於穩定的Windows 7,及聽到Windows 8的新訊息中繼續研發,並且不一定是作業系統帶動程式和工作模式,而是程式甚至是數位生活、消費和工作的習慣,帶動作業系統的研發及其更新。微軟和谷歌這方面的市場導向很深刻(雖然微軟這方面比谷歌稍嫌被動),蘋果若試圖引領風潮,創新的軟硬體和程式的協調力,就筆者打混或打滾過這附近業務來說,仍待加強。去年在手機市場上,蘋果的市佔率的確接近四成,成長了許多,目前仍看不出是否已達頂峰,若有也應該有一些前兆出現。

Information technologyHas Apple peaked?The world’s most valuable firm may be past its primeJan 26th 2013 | SAN FRANCISCO |From the print edition

TECH blogs are abuzz. Pundits are busy pumping out predictions. The company that makes the new device that is attracting so much attention is teasing reporters by being coy about its innovative features. Apple’s product launches are always like this. But this time the fuss is not about an Apple product: it is about Samsung’s latest Galaxy smartphone, which is likely to be launched in March.

Stiffer competition in smartphones and tablets from the likes of Samsung has spooked investors in Apple. They got another fright on January 23rd when the firm revealed that its latest quarterly profit of $13 billion was flat because of higher manufacturing costs. That triggered a rout in after-hours trading: at one point some $57 billion was wiped off Apple’s market capitalisation, roughly the equivalent of the entire value of Ford, a carmaker.

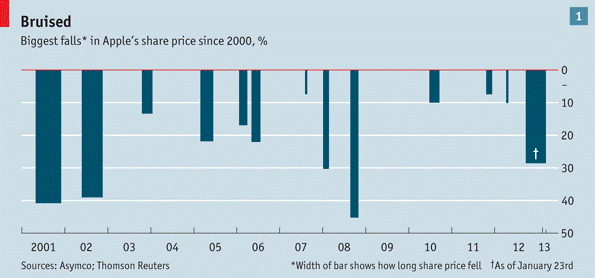

In this section · Has Apple peaked? · Read this and win million$!!! Related topics · Samsung Apple’s shares have been mauled by bears many times before (see chart 1), but they have always recovered. The big question on many investors’ minds is whether the firm can rebound again. Two things have whetted the bears’ appetites.

First, Steve Jobs, Apple’s founder and creative genius, is dead. The iPhones and iPads he sired still generate gargantuan profits. But his successor, Tim Cook, has yet to prove himself capable of bringing new breakthrough products to market. Second, Apple’s fantastic profit margins—38.6% on sales of $55 billion—attract competitors like sweetshops attract six-year-olds.

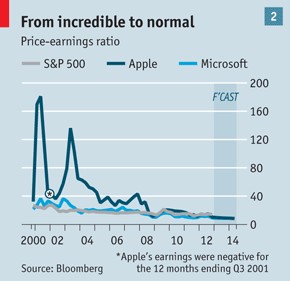

The company’s fans pooh-pooh the idea that Apple has peaked. The firm’s price-earnings ratio—11.6 at close of business on January 23rd—is not much different from Microsoft’s (see chart 2). That makes Apple’s shares look relatively sexy. Unlike Microsoft, which depends heavily on the ailing personal-computer business, Apple concentrates on sectors that are growing fast, such as smartphones and tablets. Only one of 60 analysts tracked by Bloomberg had a “sell” recommendation on Apple before this week’s stockmarket fallout.

A drizzle of negative news had already dampened investors’ ardour before this week’s earnings announcement. Apple bungled the introduction of its new mapping app, and there were rumours of cuts in component orders for the iPhone 5. But iBulls still expect sunshine this year: news of new gizmos that Apple has created and new markets it is set to disrupt.

One of those gadgets is likely to be a much cheaper iPhone aimed at emerging markets. In China, where some men have reportedly been dumped for failing to buy their girlfriends iPhone 5s, Apple sold 2m of its top-of-the-range devices over its launch weekend last month. However, most Chinese shoppers can’t afford the things. Barclays, an investment bank, reckons Apple could produce an iPhone for less than $150 to broaden its appeal.

The firm has played down reports of a cheaper iPhone, but Apple-watchers expect an announcement this year. Slimmer profit margins in China and India may be worth it to woo millions of new buyers. Apple is said to be close to a distribution agreement with China Mobile, a carrier with a hefty 700m subscribers. News of a deal may boost Apple’s shares.

Yet the best way for the company to prove it is not past its prime would be for it to disrupt another big market. Since Jobs’s death in 2011 Apple has concentrated on sprucing up its existing products. Now investors want to see it conjure up entirely new ones. All eyes are on television (though Apple is also exploring the potential of other markets, such as wearable computing: see article). Mr Cook says television is an area of “intense interest”. He told interviewers that when he switches on the TV in his living room, he feels like he has “gone backwards in time by 20 or 30 years.” This fuels expectations that Apple will launch an iTV later this year.

Sceptics point out that plenty of elegant, wafer-thin screens are already on sale. Moreover, Apple’s existing set-top box, which lets users play content from iTunes, Netflix and other services on their TVs, has not been a stunning success. But this misses the—so to speak—bigger picture. The iTV, which may be controlled via gestures and voice commands as well as via iPads and iPhones, could be a digital hub for the home. It would let people check whether their washing machine has finished its cycle while they gossip on Facebook and watch their favourite soap. Peter Misek of Jefferies, an investment bank, says sales of it should also boost purchases of iPads and other Apple gear, as more people get sucked into the firm’s “ecosystem” of linked devices and software.

But the iTV is no surefire blockbuster. For one thing, persuading cable and broadcast outfits to make programming available over the internet on demand will be tricky. They have already seen how such a model crushed music companies. For another, iTVs are likely to be pretty expensive, limiting their mass-market appeal. Apple will also, as usual, face stiff competition from Samsung. The South Korean firm is one of several that already sell smart TVs. Indeed, Samsung seems to be churning out more and more groundbreaking devices while Apple has produced only incremental innovations of late. Apple’s court battles with Samsung over smartphone patents have reinforced the impression that it is on the defensive.

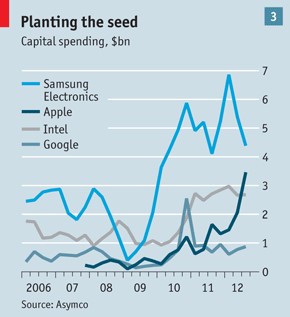

However, Horace Dediu of Asymco, a research firm, says it would be a mistake to think Apple is resting on its laurels. He notes that its capital expenditure has soared in recent quarters, reaching levels typically seen at firms with huge manufacturing operations, such as Intel (see chart 3). Some of this money is going into data centres to support cloud services like iTunes. But Mr Dediu reckons much of it is being spent on dedicated production equipment at suppliers. This could give Apple an edge in producing new gadgets.

Yet even if it produces a cheaper iPhone, pushes deep into China and wows the world with a smart TV, its shares will not reconquer last year’s peak. Competition is now tougher in its core markets. Rivals will not let it disrupt new ones so easily. Apple may dip into its $137 billion cash lake to boost its share price by paying fatter dividends or buying back more stock. That would delight some investors, but others would see it as a tacit admission that the firm’s great innovation engine has stalled. Apple won’t crumble, but it has peaked.

From the print edition: Business · Recommended · 82

Has Apple peaked? Jan 30th 2013, 16:39

Maybe now is after its peak. For a long time, Apple owns its Operating System competing with Microsoft or those who occupies smaller territory. But it costs a fortune and, in the market, it has less partner of program.

Well, Apple nevertheless has a family of high-tech product, including well-organized application or simple ideas of life, and a series of innovatively strategic marketing. The supply chain from manufacturers to clerks keeps a constant growth of Apple. I few aware of a need to consider hands-on ownership of this Syrian-oriented mark.

During the recent 2 years, Apple battled against HTC, Samsung for lawsuit of trademark and intelligence, almost getting a half of earth to go busy. Well, so horribly busy while watching news and go shopping in vendors selling electronic product. In the same kind of field, Foxconn, a strongly experienced makers of OEM, works under a contract to Apple. Also, Samsung and Toshiba offers some element of Apple’s product, like RAM and hardware.

The above sounds Apple’s vision of no problem. Sometimes Apple wins the lawsuit and sometimes it wins the pen or mouth of news medias editorial. That is to say, Apple trys very hard to go famous, indeed. The late Steve Jobs did good. The incumbent, Tim Cook, maintains the discipline as we know the number of product name rising. If there is some reversal, the only is to have customer buy more.

In the nearly a year, many US technology firms adjusts the name list of boarding room. The share price remarked a world record, yes, as we all know. Plus, the accident of Foxconn’s car crash becomes a whistle blows very soon. Apple walks toward its next stop. But it leads to a fatal circle. Is it a right way of sustainable growth? A big “No”.

With a view to mobile phone, HTC cooperate with Beats Audio with the evolution of android system and, besides, Samsung run multi-dimensional business as one of Top 10 valued global conglomerate. From the latest number, Apple occupies about a quarter of sales cake in the world. I think it may turn to a embarrassing role in IT while the rest in America, South Korea, Taiwan or Japan already find out the next, either a gold mine or just a modified organizing arrangement. After all, the bet on the hands-free is always a risky business, let alone iPad mini - the latest selling point appealing to me somewhat. The iPad mini gives me a good price nearly at that of Amazon’s Kindle Fire HD. Yeah, the unit price must fall continuously but it’s said to be an access to more potential consumers and it is hard to see the climax of Apple’s share price again.

Recommend 0 Report Permalink reply 附上一篇同年3月2日有關智慧型手機的討論文章,是否Apple的iOS及Google的安卓系統有了可預期的敵手 Smartphone operating systems Bright-eyed and bushy-tailed Apple’s iOS and Google’s Android face several hopeful challengers Mar 2nd 2013 |From the print edition · · IF YOU have a new smartphone, it is almost certainly either an Apple iPhone or one of the many devices that runs on Google’s Android operating system. According to IDC, a research firm, more than 90% of the 228m smartphones shipped in the last quarter of 2012 belonged to one of the two dominant species. Android is the bigger beast. Its share has grown as the smartphone market has boomed, to about 70%. Instead of abandoning the terrain to the two monsters, other brave creatures are emerging from the undergrowth. On February 24th (on the eve of Mobile World Congress, an annual jamboree in Barcelona) Mozilla, a non-profit organisation best known for Firefox, a web browser, unveiled plans to bring a smartphone operating system to market. Called Firefox OS, it has the backing of 18 mobile operators based in countries from Asia to Latin America. Phones running on Firefox OS will soon be on sale in nine countries. Mozilla is not alone in believing that other systems can thrive. In October Microsoft, which has never had more than a minuscule share of the phone business, brought forth Windows Phone 8. Most Windows smartphones are made by Finland’s Nokia, which dropped its own plans for a new system when it threw in its lot with the American software giant. BlackBerry, a Canadian company formerly called Research In Motion, hopes to recover lost glories with BlackBerry 10, which appeared in January after much delay. In this section · Bright-eyed and bushy-tailed · Correction: African stockmarkets Related topics · Nokia · Internet Also competing are Sailfish, developed by Jolla, a Finnish firm that took up work abandoned by Nokia; and Ubuntu, created by Canonical, a British software company, plus other firms and an army of volunteers. Even Samsung is working on another operating system, called Tizen, with Intel, a big semiconductor company that has made little progress in the mobile world. Although it is by far the biggest maker of Android smartphones—and the only one that makes much profit from them—Samsung feels the need to hedge its bets.

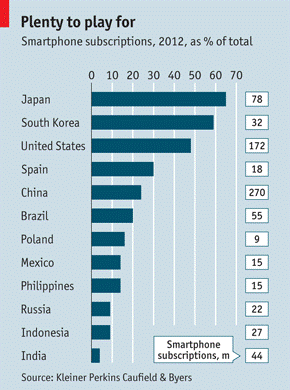

One reason for the challengers’ optimism is that a lot of ground is unoccupied. Mary Meeker of Kleiner Perkins Caufield & Byers, a venture-capital firm in Silicon Valley, estimates that late last year smartphones accounted for only 17% of the world’s mobile subscriptions. In big emerging economies such as India, Indonesia and Russia the share is less than 10%. Even rich countries are not saturated (see chart). Brazil, Mexico, Poland and Spain are among the early targets for Mozilla and its partners. BlackBerry and Microsoft have the advantage of familiarity; 80m people use BlackBerrys. Companies’ information-technology departments trust them as secure. Microsoft hopes that Windows’ dominance of personal computers can be transferred to mobiles. With that in mind, all new Windows devices, on desks, on laps or in hands, have the same look, with “tiles” for touching, not clicking. It will not be easy, of course. The sheer number of applications written for Apple and Android is a big obstacle for the new contenders. Consumers want phones with their favourite apps, and developers want to write programs only for the most popular devices. Still, operators are keen that other systems should challenge the dominant duo. At Mobile World Congress César Alierta, the boss of Telefónica, a Spanish operator which earns half its revenue in Latin America, laments “a decline in the freedom of choice of our customers who are locked into closed ecosystems”. The desire to breach those systems fires the enthusiasm of Mr Alierta and his peers for Firefox OS. Whereas most applications on Apple and Android devices have been written for those systems, Firefox OS uses open standards. In principle, apps based on it can run on any device connected to the web. Let a thousand foxes frolic. From the print edition: Business

|

|

| ( 心情隨筆|心情日記 ) |