Microsoft

Mixed week, big year

Jul 20th 2012, 12:34 by P.L.

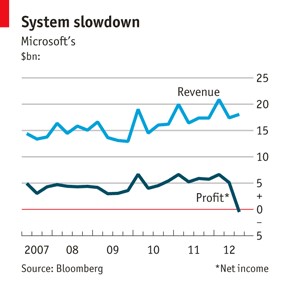

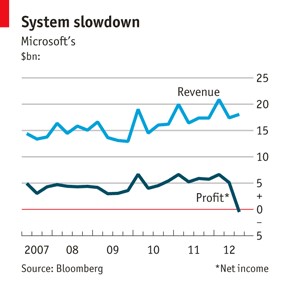

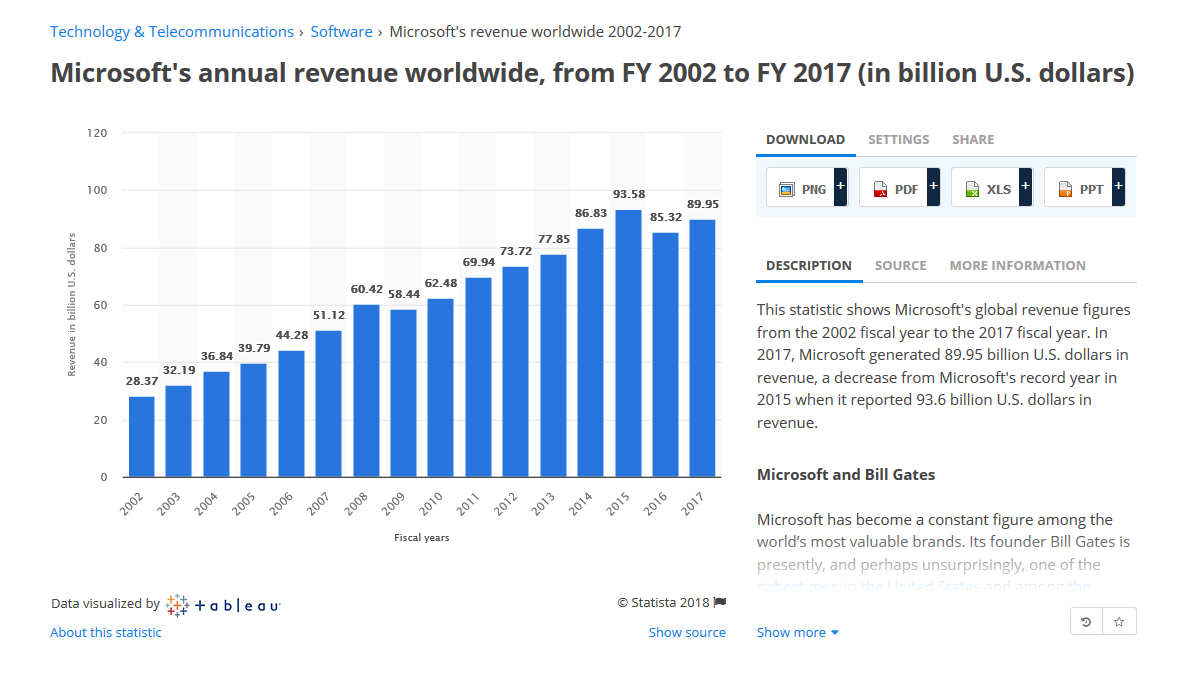

MICROSOFT’s first quarterly loss in 26 years as a public company—$492m for the three months ending to June—was eye-catching but should have been no surprise. The giant software company had already said it would write off goodwill of $6.2 billion, almost exactly what it spent on aQuantive, an advertisingbusiness, in 2007. Even less surprising, Microsoft was keener to emphasise its record revenue for the financial year just ended, $73.7 billion. Despite the write-down, it still made an annual profit of $21.8 billion. If the world economy is sluggish, it is not weighing Microsoft down much.

Embarrassing as the loss was, it was less important than what came three days before, when Microsoft unveiled its new version of Office. This almost ubiquitous suite of programs for homes and businesses, which includes Word, Excel and PowerPoint, is the company’s single biggest revenue-earner. It accounted for the vast majority of the $24 billion of revenue its business division hauled in last year. The new version, Office 2013, has plainly been created for mobile workers and consumers, using tablets and smartphones on the move as well as personal computers at their desks. It is designed for touch screens (as well as for keyboard and mouse, like the current incarnation) and for the cloud, so that users will be able to amend documents on one device and pick up from where they left off on another, or share them easily.

Having long been a huge seller in several incarnations, the chances are that Office will do very well in its latest version—at least in homes and workplaces. A knottier question is whether people will use it on the move. So far, Microsoft’s share of the mobile world, in smartphones or tablets, has been puny. Office 2013, Windows 8 (the new version of its operating system, due in October), the smartphone variant of Windows 8 and the Surface, a tablet Microsoft unveiled earlier this month, are intended to change all that.

Will they? To most people, tablets mean iPads: Apple’s device dominates the market. Office has always been designed for Windows. Although the company does make Office for Apple’s Mac computers, there is none for the iPad. Microsoft made no mention of one (or of Apple at all) this week. Indeed, Steve Ballmer (pictured), Microsoft’s chief executive, said that Office 2013 “works best with Windows 8”. Microsoft reckons that people will want Office 2013 and Windows 8—familiar products in new guises—enough to use them wherever they are. Is it right? In a few months’ time it will start to find out.

« An A-Z of business quotations: Economics

Mixed week, big year

Jul 26th 2012, 10:29

I’m not surprised at Microsoft’s first quarterly loss since a publicly traded company in 1986. For the past several years, its e-business expands into a hybrid, multi-social internetwork, after flourishing blog and vlog. More chances and angles increase user’s field of vision around the world. Behind the above is a large amount of cost of innovation and manufacturing for Microsoft and relative soft- and hardware companies. Moreover, European debt and the slowdown of BRICs’ economy somewhat affects Microsoft’s business. Microsoft bumps into the fate, tested by the unstable environment of global macroeconomics.

Really, Microsoft’s business gets worsen although new product sales like windows 8 and office 2013. For three times, I joined Computex Trade Show of Taipei in every June, listening to information speeched by Microsofts vice-president Steven Guggenheimer. This year, he introduced the latest integrated idea connecting with many fields’ leading companies, such as Samsung, LG, KIA, Toshiba, Sony, GE, Ford and ZTE. Microsoft wants to penetrate themselves into the micro-intelligence device or helper from ordinary life to professional research. These sounds good but, in the short-time, these ideas are seen as a chat rather than practices for massive product. In addition, he retrospected the critical point of Windows 7’s laptop, greeting them with the following show of Windows 8’s ones by Acer, Asus, Samsung, Sony and so on.

According to PC World, two months ago, CEO Steve Ballmer rated worst CEO in America by Adam Hartung, a Forbes contributor who pulled no punches in why he believes Ballmer should be fired. Adam cited the Vista and Zune fiascoes (for me, really nothing special), delayed product launches, and the companys falling behind in mobile; besides, he noted that Microsoft stock, at $60 a share in 2000 when Ballmer took over, typically trades in the low $30s. Well, Adam’s comment had Ballmer strongly contrast with the newly-elected Marissa Mayer as CEO of Yahoo, which just experienced a bit mess in boarding room for a while after Jerry Yang’s resignation.

After Bill Gates made Microsoft’s debut, the introduction and sale of all product not just depend on Microsoft but the satellite or technology concerned. Nowadays, the word “Microsoft” is nearly equal to Windows plus Office accompanied by portable laptop or DIY desktop. For a long time, the gross revenue comes from computer makers, who always put forward new ideas or develop innovation compatible with Windows - by cooperating with other fields while perfecting Windows as possible. For instance, the intermediation kind of laptop - like Giles Deacon for Asus, Gareth Pugh for Sony Vaio’s CR series (a jolly idea as he said) or Acer’s Ferrari with AMD - sometimes widen consumer’s appeal, making makers and Microsoft better impressive. Moreover, Microsoft develops new territory extensively with the antenna of advanced technology like game, Xbox, or handset, Windows Phone.

I began to be familiar with computer while typing Chinese characters by Yi-tian phonics at the age of 5. I still remember some MS-DOS order code and the four-button mouse for drawing (my father needs AutoCAD for work) or my playing tactics game. Several years later, I used the Windows 95 Computer which loads the basic items for work and entertainment. Since Windows 3.1, the logic of framework rectifies very few until now. Having been living in Taiwan, the No.1 high-tech 3C empire of the world, the inexpensive element of computer and well-designed product, like mainboard, had Taiwan’s innovators become world’s business leaders.

Another Microsoft’s partnership is Japan. In 1985, Toshiba developed the first worlds laptop - with MS-DOS - a milestone of digital life. Then, Fujitsu’s Masami Yamamoto created the first world’s tablet in early 1990s. Meanwhile, Sony made good use of the Vaio TV-maker’s experience to donate capital and intelligence into IT. For me, Toshiba and Sony, heading up global IT, are like Kawaii Invincible Ai Otsuka and Fashion one Ayumi Hamasaki. I have closer tie with Japan’s IT than Taiwan’s and know Toshiba’s Norio Sasaki with Atsutoshi Nishida as well as Sony’s Kazuo Hirai. With their outstanding technology, like Toshiba’s No.1 hardware as ham or Sony’s eco-friendly chosen material, Microsoft can show off more prominently and permanently.

Since Bill Gates lost the world’s richest, some rumors walk around the world. Microsoft’s relative business like Windows Server, Embedded or Xbox are limited due to less utility and poor marketing. This month, Windows 7 just replaces XP as the most popular operating system, so Windows 8 may be pessimistically predicted. I feel worried about Office 2013’s future because Windows 8 inclines user to engage in social network and entertainment; therefore, Office isnt as important as ever. Microsoft wanes little by little and need restructing. Some team work with other fields should becomes more intensive for better vision.

Recommended

13

Report

Permalink

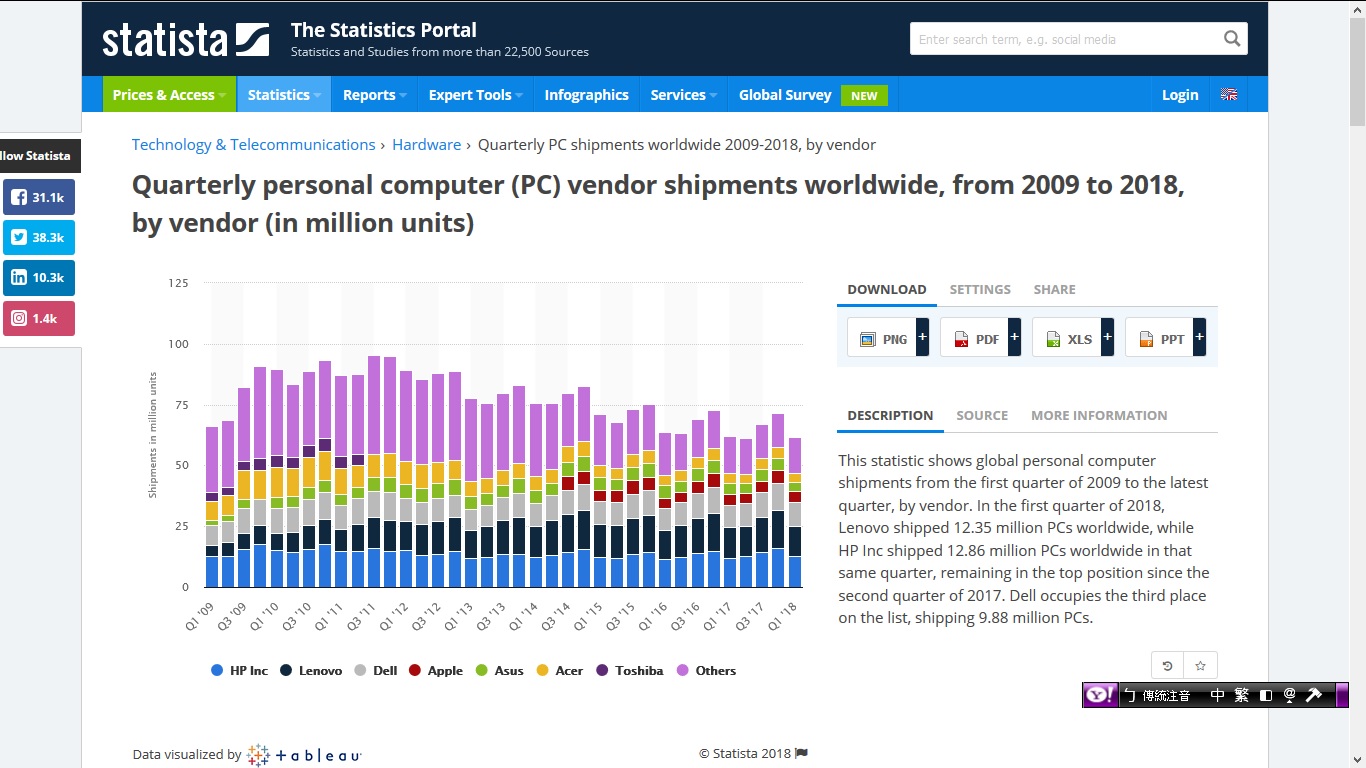

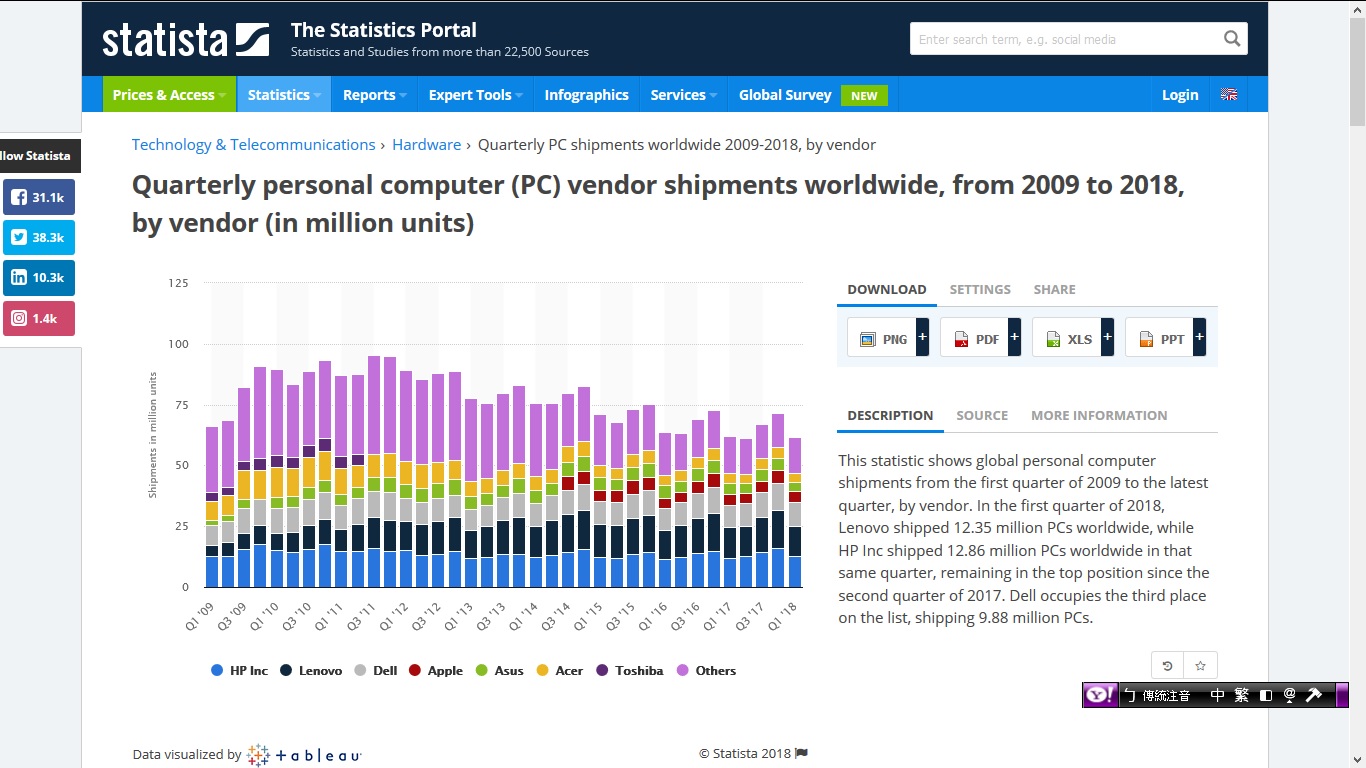

這篇寫在微軟最低潮的時候。Steve Ballmer在2000年1月至2014年2月擔任微軟執行長CEO,之後由印裔美國人Satyanarayana Nadella接任至今。在寫的當季是微軟自Ballmer接任以來最低點,第一次出現淨虧損,也就是確定了Ballmer是美國前百大企業裡面最無能的執行長。在Vista的失敗行銷策略上,Ballmer曾經感到後悔。筆者在Windows Vista釋出時得知,Vista本來是內部使用不對外聯網的作業系統,在封包裡面的建檔日期顯示早在1999年7月左右就有存在,一直到2007年才對外以商業包裝行銷。在釋出的同時又提供用戶下載Windows 7 beta,這是很失敗的訊息的釋放。不過Windows 7還算及格,沒有擴大微軟在2010-2020頭五年的損失。消費者市場裡面擁有電腦系統的裝置在2008年由惠普HP讓給了宏碁Acer又在隔年聯想Lenovo在2010年的稱霸至上月由International Data Cooperation (IDC)2017年統計,惠普HP又回到了霸主的寶座(其它相關電腦銷售業績成長或衰頹見Digital Trends 4月11日報導,可信度高因不計華碩Asus的銷售狀況)。

微軟對世界科技業及互聯網世界的影響力最大在於伺服器和消費性個人電腦產品的作業系統,從1981年在改良IBM的Dos後,建立MS-DOS是為在Windows 95前的單機作業平台。此外同時也深入有線電視業務和NBC合併成為MSNBC及開發PDA產品。2001年10月25日Windows XP問市,到Windows 7於2012年8月份讓出作業系統的龍頭寶座(筆者在原文回覆的末段有提及)。2009年10月22日微軟在亞利桑那州宣佈微軟概念店及發佈本來代號Vienna的Windows 7的問市,另外Encarta 2009的問市也打出一番名號。之外,在2001年11月推出第一代Xbox Live服務及機器,在2005年發售第二代Xbox 360及2017年的第三代Xbox One X。2010年4月12日,微軟發表的第一台自己的智慧型手機。2010年10月延宕了三年的Windows Phone行動作業系統正式問市。在這時候大部份微軟的產品策略偏為追隨者,並沒有多少是自己的創新,主要靠和製造商作發包式合作維持營收。比如動態方塊(live tiles)或是網上商店(Windows Store)和增強功能(尤其是觸控和概念整合介面)的Office 2013、2016乃至於出了配合雲端生活與工作概念的Office 365,透過微軟的消費性軟體產品,使用者漫步在雲端就能夠滿足第四波網路革命浪潮。學了Apple和Google都有自己的硬體概念產品Mac和Nexus,Windows也推出Surface,雖然起步蹣跚但也發展至今有一定成績回升,如Surface的白板版今年也要出第二代了。2015年7月29日推出Windows 10,預設瀏覽器從Internet Explorer為Edge,9月23日推出Office 365。隔年6月13日收購Linkedin商用社交軟體。

大致上筆者用過Windows XP的HP桌電,Acer的Windows XP Home Edition 32bit 的Travelmate 290與AOD150,Windows 7 Starter版的AOD255E、Windows 7 Professional (及Windows 8升級版)的Sony的VAIO SA33、Windows 7 Ultimate 64bit的Lenovo X200s、Windows XP Professional 32bit 的Kohjinsha工人舍SH小平板,中國內地白牌的台電科技x80h搭載雙系統Winodows 8.1 32bit與Android 4.4。現在筆者桌上因應不同需求,正在服役的有:兩台搭載Winodws Vista Business 32 bit 兩年半了的BenQ S31V以及Kohjinsha工人舍SR小平板,及兩台Lenovo X200 (均自行安裝正版及原廠驅動程式,一台半年多的Windows 7 Ultimate 32bit,另一台是安裝了近一年的64bit),而正在以Windows 10 家用版64bit 的Acer Aspire ES11來打出和修改讀者正在看的這篇文章,與手邊Windows Phone 8.1的Nokia Lumia 830。當然也有使用Office 97到現在365及Visio Studio及Project Manager版。除了Acer AOD150的作業系統常突然洗掉關機而有問題外,大部份還不錯。

筆者當天覺得雖然Ballmer很差,但是因為歐債的問題所以拖了微軟產品的銷售線的速度,故不見得要完全歸咎於Bill Gates的大學同學,不過也同時拿筆者在Computex-從有一年早鳥是發排汗衣到這一年的情形來講,微軟多角化和創新的經營策略仍然不足,雖舉例一些合作的廠商和實驗中的構想,但看的出來大部份是合作廠商的提議,筆者認為微軟本身的創意及在市場的主動性至今仍然不足,當然微軟相對於谷歌和蘋果電腦等公司相比,在經營管理面現在好很多而有助於營收是不可否認的。文中筆者記得小時候是從倚天公司的注音輸入,就是筆者現在用的Yahoo注音輸入法的前身,開始學起何謂電腦。筆者第一台用的是486電腦,是倫飛公司的產品,筆者父親拿來作AutoCAD繪圖要用的。筆者好奇過除了台灣的資訊及電腦代工產業,也因為大學聯考的志願序當年社會上公認是台灣大學企管系(今工商管理學系企業管理組)就是當時的日本電腦製造龍頭東芝和索尼,以及附帶致力於通訊產業的富士通公司。直至索尼的最後一款VAIO Duo系列的Windows 8時期,每一作業系統時期中索尼都是最被微軟重視的合作夥伴,而Bill Gates是從Windows XP到Windows 10幾乎每一代都是使用東芝的產品,據筆者詢問因案受查的日本東芝前CEO佐佐木哲夫先生,直到兩年前Intel第六代的電腦都是受Bill Gates的青睞,關於這間亞洲百年老店的智慧與服務態度。很可惜歷盡蒼桑的東芝轉瞬間帝國四分五裂(2015年5月會計醜聞案問題後來的當週回文會再提到)。

筆者引用長年觀察微軟和Steve Ballmer的無能問題的自由記者Adam Hartung的兩篇文章,並緊附在這篇小評論之後。2012年Forbes曾經列出五間Cisco、GE、Walmart、Sears及Microsoft的CEO都不及格非常需要直接下台(https://www.forbes.com/sites/adamhartung/2012/05/12/oops-5-ceos-that-should-have-already-been-fired-cisco-ge-walmart-sears-microsoft/3/#23be3a32783d)。「Giles Deacon for Asus, Gareth Pugh for Sony Vaio’s CR series (a jolly idea as he said)」 (or Acer’s Ferrari with AMD)引號裡面是摘錄自英國金融時報2007/08/14 Vanessa Friedman:The fashion for busmans holidays中的一段。電腦市場在Windows XP步入Vista時漸以筆記本電腦取代桌上型台式機,而處理器的性能和記憶體的周期比摩爾定律略短的這十年,各家爭奇鬥豔好不奮戰到底,有的筆電非常優秀,從主機板到零組件很完美配合作業系統,有的很容易燒毀電死人比如華碩電腦,有的仍然耐用堅固,如筆者從二手市場撿來的BenQ S31v組裝原廠電池、作業系統及至馬來西亞官方網頁下載驅動程式,加上稍快轉速的Fujitsu 7200rpm硬碟及高一階瓦數變壓器(筆者從Sony Vaio SA33損壞和Lenovo X200s的使用教訓得來的,研發出「製程」making process),就恢復原狀了,大致上筆者的Lenovo X200用過三台(兩台還正在使用)、X200s一台(在BenQ那台前是這台為第一台這麼裝,但變壓器只有90W和硬碟轉速太低而容易藍底白字和後來指示燈變紅色)及工人舍兩台(1.8吋硬碟沒換用原廠的,一台SH給舍弟用了)都是這麼組裝而成的。

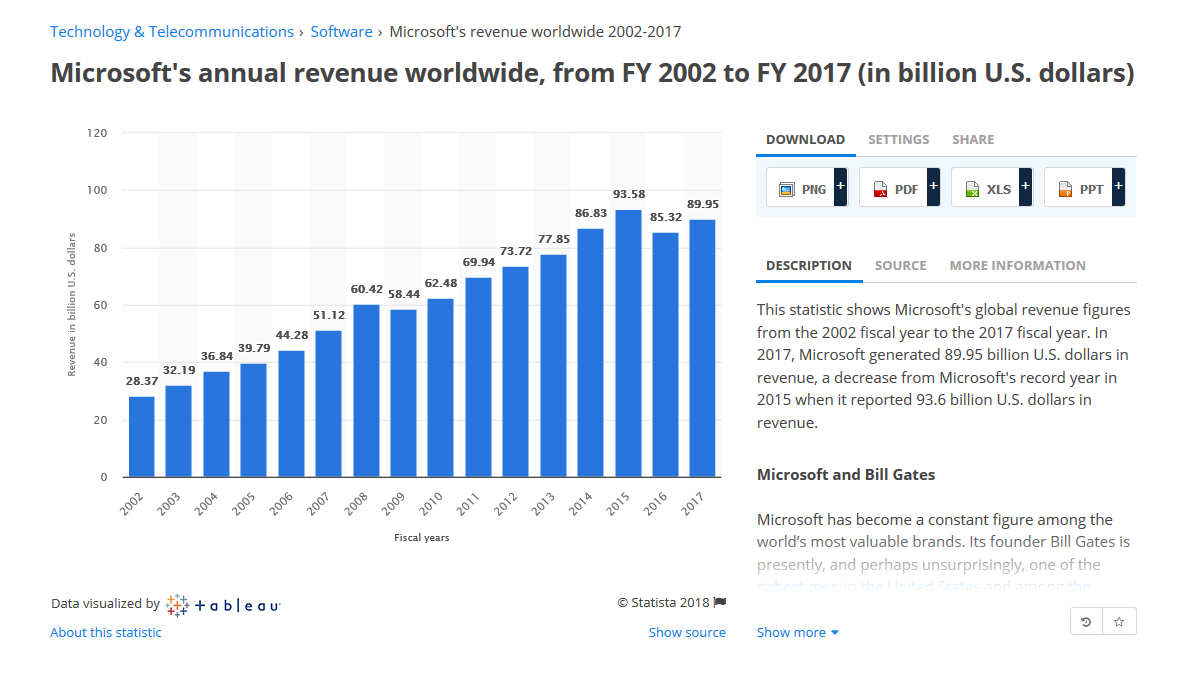

回顧這些起起落落,微軟仍然偏摸石頭問路,比如Windows Phone和Encarta這兩類產品就是模菱兩可的成果,而Surface一開始市場偏觀望而到今天能衍生出如此多樣產品,又Office 365的需求仍然很大。2017年Fortune雜誌以$89.95bn 營收排第30名,敘述如下:「Microsoft’s foray into cloud computing continues to pay off. In March, Microsoft CEO Satya Nadella reorganized the company to deemphasize the once mighty Windows operating system in favor of the faster growing Azure cloud computing business. The tweaks were important, both strategically and symbolically. Microsoft may have missed out on the rise of mobile, but it’s going full steam ahead in the cloud. Buoyed by strong growth over the past year, the company’s shares have soared 40% during the 12 months ending in May.」

Statistas 的PC Sales統計數據:

In the first quarter of 2018, Lenovo shipped 12.35 million PCs worldwide, while HP Inc shipped 12.86 million PCs worldwide in that same quarter, remaining in the top position since the second quarter of 2017. Dell occupies the third place on the list, shipping 9.88 million PCs.

*上述Steve Ballmer為美國上市公司中,最嚴重的不及格CEO的評論依據:

Microsoft CEO Steve Ballmer Rated Worst CEO in America

Steve Ballmer has probably faced more long-time criticism than any CEO in America. And now theres this: A Forbes writer rates him as the CEO who most deserves to be fired.

Adam Hartung, a Forbes contributor, pulls no punches in why he believes Ballmer should be fired, writing in part:

"Without a doubt, Mr. Ballmer is the worst CEO of a large publicly traded American company today. Not only has he singlehandedly steered Microsoft out of some of the fastest growing and most lucrative tech markets (mobile music, handsets and tablets) but in the process he has sacrificed the growth and profits of not only his company but ecosystem companies such as Dell, Hewlett Packard and even Nokia. The reach of his bad leadership has extended far beyond Microsoft when it comes to destroying shareholder value -- and jobs."

He cites the Vista and Zune fiascos, delayed product launches, and the companys falling behind in mobile as examples of his failures, and notes that Microsoft stock was at $60 a share in 2000 when Ballmer took over, and now typically trades in the low $30s.

He then writes:

"Years late to market, he has bet the company on Windows 8 -- as well as the future of Dell, HP, Nokia and others. An insane bet for any CEO – and one that would have been avoided entirely had the Microsoft Board replaced Mr. Ballmer years ago with a CEO that understands the fast pace of technology shifts and would have kept Microsoft current with market trends."

In the past few years, there have been other calls for Ballmers firing or resignation. A year ago,

influential hedge fund manager David Einhorn said Ballmer should step down, saying "His continued presence is the biggest overhang on Microsofts stock." Back in September of 2010, Ballmer

received only half of his possible bonus due to failures related to the Kin, mobile phones, and tablets. On the site

Glassdoor.com, Microsoft employees have also

rated Ballmer as the worst tech CEO.

As GeekWire points out, though, Ballmer has also had some successes, including SharePoint, the growth of Microsoft Office, SQL Server and Windows Server, and the Xbox business.

Thats true, but Ballmers failures outpace his successes, particularly in mobile. As to whether hes Americas worst CEO I cant say. But by most measures, under his leadership Microsofts standing in the tech world has deteriorated, not strengthened.

This story, "Microsoft CEO Steve Ballmer Rated Worst CEO in America" was originally published by Computerworld.

To comment on this article and other PCWorld content, visit our

Facebook page or our

Twitter feed.

*Adam Hartung的三篇文章於其個人網頁 https://adamhartung.com/ 早在2010年10月即有一篇很深入而稍沉悶的討論

Summary:

- Steve Ballmer received only half his maximum bonus for last year

- But Microsoft has failed at almost every new product initiative the last several years

- Microsofts R&D costs are wildly out of control, and yielding little new revenue

- Microsoft is lagging in all new growth markets – without competitive products

- Microsofts efforts at developing new markets have created enormous losses

- Cloud computing could obsolete Microsofts "core" products

- Why didnt the Board fire Mr. Ballmer?

Reports are out, including at AppleInsider.com that "Failures in Mobile Space Cost Steve Ballmer Half his Bonus." Apparently the Board has been disappointed that under Mr. Ballmers leadership Microsoft has missed the move to high growth markets for smartphones and tablets. Product failures, like Kin, have not made them too happy. But the more critical question is — why didnt the Board fire Mr. Ballmer?

A decade ago Microsoft was the undisputed king of personal software. Its near monopoly on operating systems and office automation software assured it a high cash flow. But over the last 10 years, Microsoft has done nothing for its shareholders or customers. The XBox has been a yawn, far from breaking even on the massive investments. All computer users have received for massive R&D investments are Vista, Windows 7 and Office 2007 followed by Office 2010 — the definition of technology "yawners." None of the new products have created new demand for Microsoft, brought in any new customers or expanded revenue. Meanwhile, the 45% market share Microsoft had in smartphones has shrunk to single digits, at best, as Apple and Google are cleaning up the marketplace. Early editions of tablets were dropped, and developers such as HP have abandoned Microsoft projects.

Yet, other tech companies have done quite well. Even though Apple was 45 days from bankruptcy in 2000, and Google was a fledgling young company, both Apple and Google have launched new products in smartphones, mobile computing and entertainment. And Apple has sold over 4 million tablets already in 2010 – while investors and customers wait for Microsoft to maybe get one to market in 2011.

Despite its market domination, Microsofts revenues have gone nowhere. And are projected to continue going relatively nowhere. While Apple has developed new growth markets, Microsoft has invested in defending its historical revenue base.

MSFT vs AAPL revenue forecast 4.10

Source: SeekingAlpha.com

Yet, Microsoft spent 8 times as much on R&D in 2009 to accomplish this much lower revenue growth. At a recent conference Mr. Ballmer admitted he thought as much as 200 man years of effort was wasted on Vista development in recent years. That Microsoft has hit declining rates of return on its investment in "defending the base" is quite obvious. Equally obvious is its clear willingness to throw money at projects even though it has no skill for understanding market needs sin order for development to yield anything commercially successful!

RD cost MSFT and others 2009

Source: Business Insider.com

And investments in opportunities outside the "core" business have not only failed to produce significant revenue, theyve created vast losses. Such as the horrible costs incurred in on-line markets. Trying to launch Bing and compete with Google in ad sales far too late and with weak products has literally created losses that exceed revenues!

Microsoft-operating-income

Source: BusinessInsider.com

And the result has been a disaster for Microsoft shareholders – literally no gain the last several years. This has allowed Apple to create a market value that actually exceeds Microsofts. An idea that seemed impossible during most of the decade!

Apple v msft mkt cap 05.24.10

Source: BusinessInsider.com

Under Mr. Ballmers leadership Microsoft has done nothing more than protect market share in its original business – and at a huge cost that has not benefited shareholders with dividends or growth. No profitable expansion into new businesses, despite several newly emerging markets. And now late in practically every category. Costs for business development that are wildly out of control, despite producing little incremental revenue. And sitting on a business in operating systems and office software that is coming under more critical attack daily by the shift toward cloud computing. A shift that could make its "core" products entirely obsolete before 2020.

Given this performance, giving Mr. Ballmer his "target" bonus for last year seems ridiculous – even if half the maximum. The proper question should be why does he still have his job? And if you still own Microsoft stock — why as well?

Anyone who reads my column knows I’ve been no fan of Steve Ballmer as CEO of Microsoft. On multiple occasions I chastised him for bad decisions around investing corporate funds in products that are unlikely to succeed. I even called him the worst CEO in America. The Washington Post even had difficulty finding reputable folks to disagree with my argument.

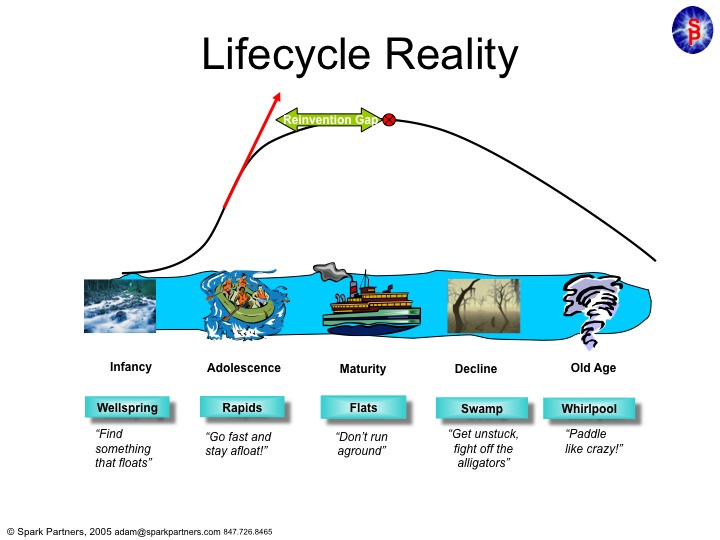

Unfortunately, Microsoft suffered under Mr. Ballmer. And Windows 8, as well as the Surface tablet, have come nowhere close to what was expected for their sales – and their ability to keep Microsoft relevant in a fast changing personal technology marketplace. In almost all regards, Mr. Ballmer was simply a terrible leader, largely because he had no understanding of business/product lifecycles.

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.

Under Mr. Gates leadership Microsoft single-handedly overtook the original PC innovator – Apple – and left it a niche company on the edge of bankruptcy in little over a decade.

Mr. Gates kept Microsoft’s growth constantly in the double digits by not only making superior operating system software, but by pushing the company into application software which dominated the desktop (MS Office.) And when the internet came along he had the vision to be out front with Internet Explorer which crushed early innovator, and market maker, Netscape.

But then Mr. Gates turned the company over to Mr. Ballmer. And Mr. Ballmer was a leader lacking vision, or innovation. Instead of pushing Microsoft into new markets, as had Mr. Gates, he allowed the company to fixate on constant upgrades to the products which made it dominant – Windows and Office. Instead of keeping Microsoft in the Rapids of growth, he offered up a leadership designed to simply keep the company from going backward. He felt that Microsoft was a company that was “mature” and thus in need of ongoing enhancement, but not much in the way of real innovation. He trusted the market to keep growing, indefinitely, if he merely kept improving the products handed him.

As a result Microsoft stagnated. A “Reinvention Gap” developed as Vista, Windows 7, then Windows 8 and one after another Office updates did nothing to develop new customers, or new markets. Microsoft was resting on its old laurels – monopolistic control over desktop/laptop markets – without doing anything to create new markets which would keep it on the old growth trajectory of the Gates era.

Things didn’t look too bad for several years because people kept buying traditional PCs. And Ballmer famously laughed at products like Linux or Unix – and then later at entertainment devices, smart phones and tablets – as Microsoft launched, but then abandoned products like Zune, Windows CE phones and its own tablet. Ballmer kept thinking that all the market wanted was a faster, cheaper PC. Not anything really new.

And he was dead wrong. The Reinvention Gap emerged to the public when Apple came along with the iPod, iTunes, iPhone and iPad. These changed the game on Microsoft, and no longer was it good enough to simply have a better edition of an outdated technology. As PC sales began declining it was clear that Ballmer’s leadership had left the company in the Swamp, fighting off alligators and swatting at mosquitos with no strategy for how it would regain relevance against all these new competitors.

So the Board pushed him out, and demoted Gates off the Chairman’s throne. A big move, but likely too late. Fewer than 7% of companies that wander into the Swamp avoid the Whirlpool of demise. Think Univac, Wang, Lanier, DEC, Cray, Sun Microsystems (or Circuit City, Montgomery Wards, Sears.) The new CEO, Satya Nadella, has a much, much more difficult job than almost anyone thinks. Changing the trajectory of Microsoft now, after more than a decade creating the Reinvention Gap, is a task rarely accomplished. So rare we make heros of leaders who do it (Steve Jobs, Lou Gerstner, Lee Iacocca.)

So what will happen at the Clippers?

Critically, owning an NBA team is nothing like competing in the real business world. It is a closed marketplace. New competitors are not allowed, unless the current owners decide to bring in a new team. Your revenues are not just dependent upon you, but are even shared amongst the other teams. In fact your revenues aren’t even that closely tied to winning and losing. Season tickets are bought in advance, and with so many games away from home a team can do quite poorly and still generate revenue – and profit – for the owner. And this season the Indiana Pacers demonstrated that even while losing, fans will come to games. And the Philadelphia 76ers drew crowds to see if they would set a new record for the most consecutive games lost.

In America the major sports only modestly overlap, so you have a clear season to appeal to fans. And even if you don’t make it into the playoffs, you still share in the profits from games played by other teams. As a business, a team doesn’t need to win a championship to generate revenue – or make a profit. In fact, the opposite can be true as Wayne Huizenga learned owning the Championship winning Florida Marlins baseball team. He payed so much for the top players that he lost money, and ended up busting up the team and selling the franchise!

In short, owning a sports franchise doesn’t require the owner to understand lifecycles. You don’t have to understand much about business, or about business competition. You are protected from competitors, and as one of a select few in the club everyone actually works together – in a wholly uncompetitive way – to insure that everyone makes as much money as possible. You don’t even have to know anything about managing people, because you hire coaches to deal with players, and PR folks to deal with fans and media. And as said before whether or not you win games really doesn’t have much to do with how much money you make.

Most sports franchise owners are known more for their idiosyncrasies than their business acumen. They can be loud and obnoxious all they want (with very few limits.) And now that Mr. Ballmer has no investors to deal with – or for that matter vendors or cooperative parties in a complex ecosystem like personal technology – he doesn’t have to fret about understanding where markets are headed or how to compete in the future.

When it comes to acting like a person who knows little about business, but has a huge ego, fiery temper and loves to be obnoxious there is no better job than being a sports franchise owner. Mr. Ballmer should fit right in.

*Digital Trends的各家電腦零售情況報導

Despite PC industry’s flat year-to-year growth, HP dominated first-quarter sales

By Kevin Parrish — Posted on April 11, 2018 - 3:24PM

HP commanded the North American market in the first quarter of 2018 according to the latest report from International Data Corporation (IDC). The company seized 22.6 percent of the market followed by Lenovo at 20.4 percent, Dell at 16.9 percent, Acer at 6.8 percent, and Apple at 6.6 percent. Compared to the same quarter in 2018, HP grew 4.3 percent while Lenovo evened out and Dell grew 6.4 percent. Acer and Apple actually dropped 7.7 and 4.8 percent, respectively.

Overall, the PC market growth remained flat in the first quarter compared to the same period in 2017, with no rise or fall in shipments. The statistics include desktops, laptops, and workstations, which combined saw 60.4 million units sold globally in the first quarter of 2018. Market watchers previously predicted a 1.5 percent decline.

Driving the PC market is a demand for premium notebooks in the mainstream and commercial markets. Gaming systems are also part of the equation as hardware prices continue to drop to better address budget-oriented wallets without sacrificing performance. According to the report, an improved supply of “key components” brought prices down to help smaller vendors recover their share of their PC market.

“The component shortage that initially impacted portions of 2017 led some vendors to stock up inventory to avoid expected component price hikes, and that led to some concerns of excess stock that would be hard to digest in subsequent quarters,” said Jay Chou, research manager with IDC’s Personal Computing Device Tracker. “However, the market is continuing on a resilient path that should see modest commercial momentum through 2020.”

The report shows that in North America alone, 13.5 million units shipped during the first quarter. For the EMEA region (Europe, Middle East, Africa), the report doesn’t state how many units actually shipped, but instead says the region’s PC market showed stable growth. Notebooks maintained a growth trajectory due to increased mobile adoption and customer awareness while desktops experienced strong results thanks to a growing gaming community and long-awaited device refreshes.

In the Asia-Pacific region, the quarter ended on a different note. China’s PC market performed lower than expected due to a “softer demand” and a fewer number of promotions. Japan fell below expectations as well stemming from a lackluster fourth quarter in 2017 but still managed to see some growth in 2018’s first quarter. The report states that Japan’s first three quarters of 2017 “affected future demand.”

Just in the past few weeks, device makers have shown that the PC platform is far from dead, especially for gamers. HP’s refreshed portfolio is the most recent, addressing mainstream gamers, general customers, and those looking for an alternative to Windows. Asus rolled out new and refreshed laptops under its Republic of Gamers brand while Samsung just debuted its Notebook Odyssey Z gaming laptop. Dell loves PC gamers, too, with four new G Series laptops.

“The year kicked off with optimism returning to the U.S. PC market, especially on the notebook side,” said Neha Mahajan, senior research analyst, Devices and Displays. “The retail platform shows signs of stability especially with a fast-growing gaming community adding to the confidence.”

*附當年筆者寫作回文時所參考Bloomberg的報導

Microsoft posts 1st ever quarterly loss

US high-tech giant Microsoft has reported its first quarterly loss since becoming a publicly traded company in 1986. The loss is due to poor performance of its online advertising business.

The firm released its earnings report for the April-June period on Thursday.

The report says revenue grew 4 percent from the same period last year, to about 18 billion dollars. It attributes the gain to strong sales of the Office software suite and home videogame consoles.

But the company took a charge of 6.2 billion dollars related to its acquisition of online ad service aQuantive in 2007. The service has failed to generate revenue, leading to a net loss of 492 million dollars for the quarter.

Microsoft hopes to improve earnings by shifting its focus from personal computers to tablets and smartphones. It is working toward that goal by launching the Windows 8 operating system in October.

Chief Executive Steve Ballmer says hes confident business will turn around because Microsoft will release a record number of core products this year.

Jul. 20, 2012 - Updated 04:33 UTC (13:33 JST)

Microsoft Unearned Revenue Tops Estimates on Upgrades

Bloomberg News, sent from my Android phone

(Corrects spelling of BGC Partners in final paragraph.)

Microsoft Corp. (MSFT) reported fourth- quarter unearned revenue, a yardstick of future sales, that topped analysts’ estimates, a sign that the largest software maker will benefit from corporate demand for its programs.

Unearned revenue was $20.1 billion in the three months that ended June 30, Redmond, Washington-based Microsoft said today in a statement. Analysts on average expected $19.4 billion, according to Heather Bellini, an analyst at Goldman Sachs Group Inc. Bellini’s own estimate was for $18.9 billion. Profit -- excluding a writedown that gave Microsoft its first loss as a publicly traded company -- also topped estimates after Microsoft reined in expenses.

Unearned sales got a boost as companies placed multiyear orders for such products as Office and database software, even as they delayed other technology purchases amid weakness in the economy. Business buying helped compensate for diminished demand from consumers awaiting the Oct. 26 release of Windows 8, the next version of Microsoft’s main operating system, or opting for machines made by Apple Inc. and other competitors.

“The deferred revenue number was pretty good, which gives you an indication of future growth, so that’s encouraging,” said Brendan Barnicle, an analyst at Pacific Crest Securities who rates the shares “sector perform.” “Given all we know about weakness in PCs, it’s not surprising that sales numbers came in a little light particularly on the Windows side.”

Excluding the writedown, related to the acquisition of AQuantive Inc., profit was 67 cents a share. That exceeded the 62-cent average estimate of analysts compiled by Bloomberg. Sales rose 4 percent to $18.1 billion, compared with the $18.2 billion average projection.

Expense Reduction

Sales and marketing costs dropped 3.5 percent to $3.78 billion. Those savings, as well as a tax rate that was lower than analysts had predicted, contributed to profit, Microsoft Chief Financial Officer Peter Klein said in an interview.

Microsoft shares rose 2.3 percent to $31.38 in extended trading after the report. The stock had gained less than 1 percent to $30.67 at the close in New York. It fell 5.2 percent in the three months through the end of June, compared with a 3.3 percent drop for the Standard and Poor’s 500 Index.

During the quarter, Microsoft wrote down $6.2 billion for the impairment of goodwill related to its $6.3 billion purchase of Internet-advertising company AQuantive Inc., an indication the company’s online business won’t grow as quickly as Microsoft once projected. That non-cash charge is not factored into analysts’ estimates for profit in the quarter.

Microsoft said operating expenses for the year that began July 1 will be $30.3 billion to $30.9 billion, reiterating a projection made in April.

PC Weakness

Revenue in the Windows division fell 13 percent to $4.15 billion, below the $4.44 billion average estimate of analysts surveyed by Bloomberg. That was the fifth time in seven quarters that the unit has fallen short.

Consumer PC demand was weaker than corporate demand in the period, as was the case in other recent quarters, Klein said. The trend will probably start reversing with the release of Windows 8, he said. He declined to give a projection.

Global PC shipments stalled in the quarter, marking a seventh-straight quarter of tepid growth, amid weakness in Europe and the growing popularity of tablets, research released this month by Gartner Inc. showed.

Top chipmaker Intel Corp. (INTC) this week scaled back its annual sales forecast as personal computer-demand fails to rebound among consumers in the U.S. and Europe.

“The macroeconomic environment’s really a little weaker than we saw when we began the year,” Intel Chief Financial Officer Stacy Smith said in a Bloomberg Television interview.

Low Expectations

Windows sales have suffered as some consumers opt for tablets instead of cheaper laptops running Windows.

Tablets with Windows 8, including Microsoft’s first-ever foray into the computer hardware market with its own Surface tablet, are set to go on sale Oct. 26. Until then, Microsoft won’t be able to materially reverse the trend of customers defecting to rivals’ tablets, Klein has said.

Sales in the Business Division, largely made up of Office software, rose 7.1 percent to $6.29 billion. That compares with the $6.35 billion average analyst estimate.

The company is also in the final stages of development on a new version of Office, code-named Office 15, which was unveiled and released in a public test version this month.

Server and Tools revenue rose 13 percent to $5.09 billion. Analysts had estimated $5.18 billion, on average.

Revenue in Entertainment and Devices, the unit that includes the Xbox gaming console, rose 20 percent to $1.78 billion. That compares with a $1.66 billion average analyst estimate.

“It was a great fourth-quarter for them in terms of signing contracts,” said Colin Gillis, an analyst at BGC Partners LP. “Let’s be honest, it wasn’t the highest bar for them this quarter because of the poor macroeconomic environment and the PC market. People weren’t expecting that much.”

To contact the reporter on this story: Dina Bass in Seattle at dbass2@bloomberg.net

To contact the editor responsible for this story: Tom Giles at tgiles5@bloomberg.net

Find out more about Bloomberg for Android: http://m.bloomberg.com/android

*Venturebeat 2018/01/31的報導:微軟因Azure的預期大幅成長關係,收益優於市場預期及商用Surface Hub搭載Microsoft 365出第二代機款

Microsoft reports $28.9 billion in Q2 2018 revenue: Azure up 98%, Surface up 1%, and Windows up 4%

Emil Protalinski@EPro January 31, 2018 1:06 PM

Image Credit: Mike Segar / Reuters

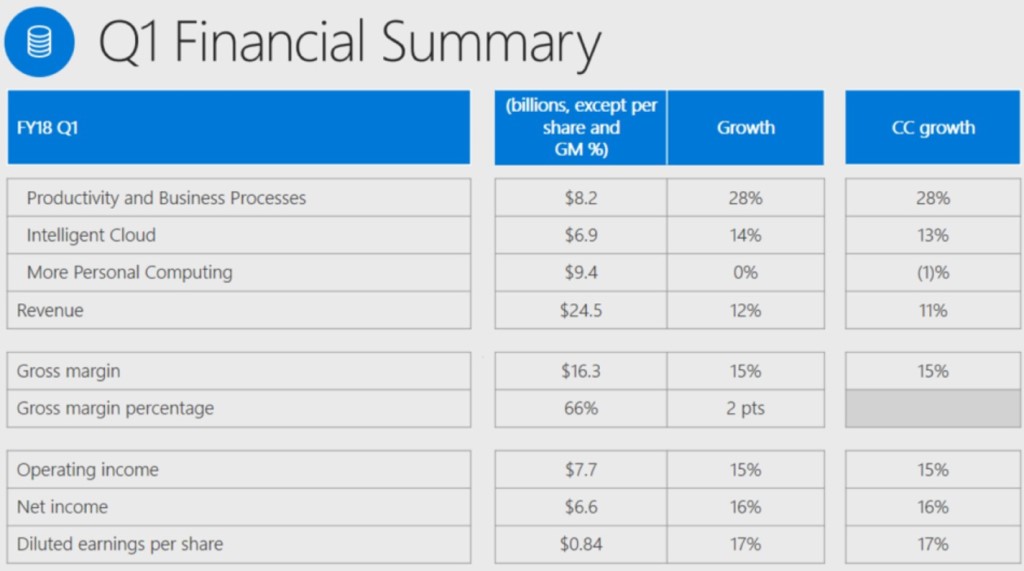

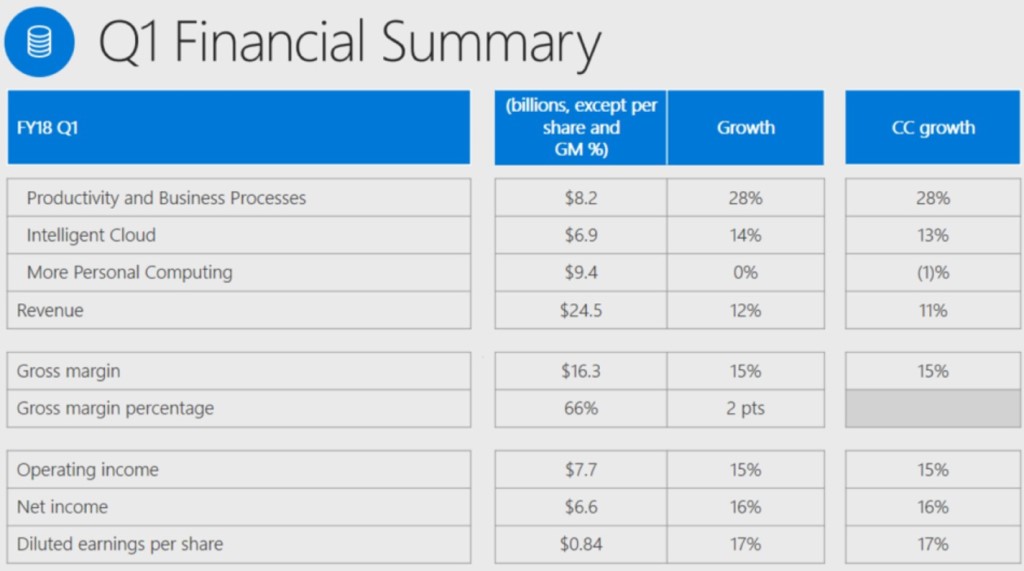

Microsoft today reported earnings for its second fiscal quarter of 2018, including revenue of $28.9 billion, net income of $7.5 billion, and earnings per share of $0.96 (compared to revenue of $26.1 billion, net income of $6.5 billion, and earnings per share of $0.83 in Q2 2017). All three of the company’s operating groups saw growth. The quarter’s results also included a net charge of $13.8 billion due to the Tax Cuts and Jobs Act.

Analysts had expected Microsoft to earn $28.39 billion in revenue and earnings per share of $0.86. In short, the company beat expectations. The company’s stock was up 2.45 percent in regular trading, but largely flat in after-hours trading. Microsoft said it returned $5 billion to shareholders in the form of share repurchases and dividends during the quarter.

“This quarter’s results speak to the differentiated value we are delivering to customers across our productivity solutions and as the hybrid cloud provider of choice,” Microsoft CEO Satya Nadella said in a statement. “Our investments in IoT, data, and AI services across cloud and the edge position us to further accelerate growth.”

Last quarter, Microsoft’s cloud annualized run rate passed $20 billion, ahead of schedule. Nadella’s plan to turn Microsoft into a cloud company is working.

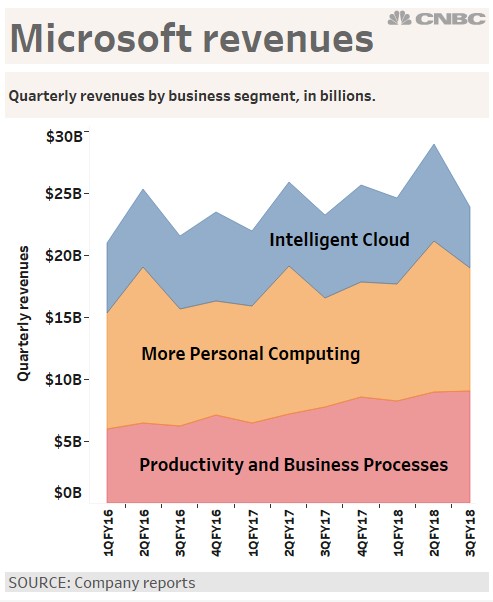

Here are the highlights across the company’s three operating groups:

- Productivity and Business Processes: Up 25 percent to $9.0 billion. Office commercial revenue grew 10 percent, Office consumer revenue was up 12 percent, and Dynamics revenue increased 10 percent. Office 365 subscribers hit 29.2 million. LinkedIn contributed revenue of $1.3 billion.

- Intelligent Cloud: Up 15 percent to $7.8 billion. Server products and cloud services revenue grew 18 percent while Enterprise Services revenue increased 5 percent. But the big number as always was Azure revenue, which grew 98 percent.

- More Personal Computing: Up 2 percent at $12.2 billion. Windows OEM revenue was up 4 percent while Windows commercial revenue increased 4 percent. Search acquisition advertising revenue minus traffic acquisition costs jumped 15 percent. Surface revenue increased by 1 percent, and gaming revenue was up 8 percent (driven largely by the Xbox One X).

The fact that Surface revenue is flat is surprising. The Surface Laptop helped the company in the previous quarter, but it looks like the Surface Book 2 didn’t make much of a dent. That said, the current quarter will give us a full three months of sales, so we’ll be able to make a better call in Q3 2018.

Microsoft’s lighter, higher-resolution Surface Hub 2 will ship in 2019

Kyle Wiggers@Kyle_L_WiggersMay 15, 2018 07:29 AM

The Surface Hub, Microsoft’s 84-inch 4K digital whiteboard designed for conferences and meetings, received a hardware refresh today. The new and improved Surface Hub 2 boasts a higher-resolution touchscreen than the original, plus dual removable 4K rotating front cameras that support video calling, enhanced far-field microphones, and other improvements.

The most obvious change is the form factor. The 50.5-inch Surface Hub 2 trades the outgoing model’s 16:9 aspect ratio for 3:2, ups the resolution to “greater than 4K,” and reduces the weight to between 55 and 77 pounds, which is lighter than the first Surface Hub. This apparently brings it in line with Microsoft’s Surface laptops and tablets, which the company says were designed to give the look and feel of a piece of paper.

The reduced weight and size allow the Surface Hub 2 to sit on a rolling easel-like stand for portability or mount to a wall — in a blog post, Microsoft said it’s working with Steelcase to produce wall mounts and stands. The Surface Hub 2’s specially engineered hinge allows it to spin 0 to 90 degrees while dynamically adjusting the orientation of content on the screen. Another nifty feature, called tiled display, allows up to four Surface Hub 2s to be or interlinked side by side to form a single, ultra-wide screen.

Under the hood, the Surface Hub 2 runs Microsoft 365, an enterprise software suite consisting of Windows 10, Office 365, Enterprise Mobility Security, Microsoft Teams (Microsoft’s Slack-like group chat app), and Microsoft Whiteboard. (The outgoing Surface Hub ran “Windows 10 Team,” a customized version of Windows 10 Enterprise.) Unsurprisingly, there’s a heavy emphasis on collaboration: Microsoft says it’s developing an ambient display mode, called dynamic collaboration, that will allow people to log into the Surface Hub 2 using the built-in fingerprint reader and pull their work into a single “collaborative” document stored in the cloud. While logged in, they’ll also have access to coworkers’ histories and data.

The Microsoft Hub 2 enters a crowded field of digital whiteboards, where it’ll compete squarely with Jamboard, Google’s $5,000 4K GSuite-optimized whiteboard, and Cisco’s $4,990 Spark Board, which runs the company’s Spark Flex enterprise subscription suite, among others.

Microsoft declined to provide a release date or pricing but said that it’ll begin testing the Surface Hub 2 with “select commercial customers” this year ahead of general availability in 2019. The original Surface Hub started at $9,000.

Time will tell if the Surface Hub 2 can replicate the success of the original Surface Hub, which shipped to 5,000 customers across 25 markets last year, according to Microsoft.

*NBC分析今年(2018年4月)預計微軟全年是回穩揚升的一年

Microsoft stock up after strong guidance

- The company beat estimates on earnings and revenue.

- The Azure cloud had 93 percent revenue growth, which is up from the previous quarter.

- The companys major More Personal Computing segment included 21 percent revenue growth from Windows commercial products and cloud services.

Jordan Novet | @jordannovet

Published 3:26 PM ET Thu, 26 April 2018 Updated 6:55 PM ET Thu, 26 April 2018 CNBC.com

Microsoft beats the Street 4:57 PM ET Thu, 26 April 2018 | 00:49

Microsoft saw its stock fall as much as 2.5 percent on Thursday immediately after the company reported better-than-expected earnings for its fiscal third quarter. But the stock jumped after the company provided estimates for the quarters to come.

- Earnings: 95 cents per share, excluding certain items, vs. 85 cents per share as expected by analysts, according to Thomson Reuters.

- Revenue: $26.82 billion, vs. $25.77 billion as expected by analysts, according to Thomson Reuters.

In terms of guidance, CFO Amy Hood told analysts on a call after the earnings statement that Microsoft is expecting $28.8-29.5 billion in revenue in its fiscal fourth quarter. Analysts had expected the company to forecast $28.01 billion in revenue for that quarter, according to Thomson Reuters.

The stock rose to 3 percent above the closing price of $94.26 per share after Hood announced the guidance.

Hood also made brief remarks about the companys upcoming 2019 fiscal year. "Revenue growth will continue to be driven by the transition to cloud services, she said.

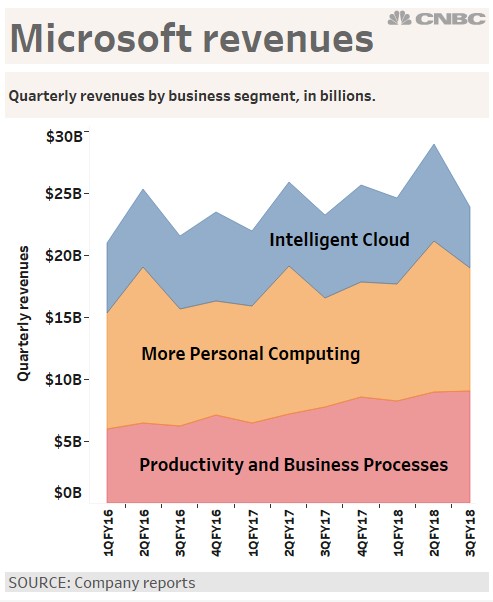

Overall, Microsofts revenue grew 16 percent year over year in the quarter, which was the third quarter of the companys 2018 fiscal year, according to Thursdays earnings statement.

The companys biggest business segment, More Personal Computing -- which includes Windows, devices, gaming and search ads -- produced $9.92 billion in revenue, up 13 percent year over year. The segment came in above the FactSet consensus estimate of $9.25 billion, according to StreetAccount.

The Productivity and Business Processes segment, which includes Office, LinkedIn and Dynamics, came up with $9.01 billion in revenue, which was up 16.8 percent and above the FactSet consensus estimate of $8.73 billion, according to StreetAccount.

Microsofts Intelligent Cloud segment, containing server products and cloud services, grew 17.3 percent with $7.90 billion in revenue. The results exceeded the $7.68 billion FactSet estimate.

In the fiscal third quarter Microsoft acquired data storage company Avere and gaming start-up PlayFab, and it announced a major reorganization that included the departure of Windows and Devices chief Terry Myerson from the company. The Windows and Devices Group was effectively split up and put inside the Experiences and Devices group (which includes Microsofts Office 365 and other productivity applications) and the Cloud and Artificial Intelligence Platform group (which includes infrastructure products like Windows Server and the Azure cloud platform).

"We think folding Windows into the new Experiences and Devices division, which is led by a former Office executive, sends a strong signal of the supporting, and not leading, role Windows will likely take in coming years, and we like the continued emphasis on hybrid cloud and [artificial intelligence]," Stifel analysts led by Brad Reback wrote in a Sunday note.

But Windows remains the main revenue contributor for Microsofts More Personal Computing business segment. One indicator for Windows sales, IDCs PC shipments, was flat year over year in the first quarter of 2018 but better than expected, the Stifel analysts wrote.

Intelligent Cloud contains the Azure public cloud, which competes with Amazon Web Services and represents Microsofts biggest growth driver overall. Microsoft as usual didnt provide an exact revenue figure for Azure but did say revenue rose 93 percent year over year, which is down sequentially from 98 percent revenue growth. The Stifel analysts said they were expecting growth just over 90 percent, while analysts led by Kirk Materne at Evercore ISI said in a Sunday note they were looking for 82 percent Azure growth.

The deceleration in Azures revenue growth could have been one factor that caused Microsoft stock to fall immediately after the company reported earnings, Piper Jaffray analyst Alex Zukin told CNBC.

On the call with analysts after the earnings release, Microsoft CEO Satya Nadella said that one Azure service, the Cosmos DB database offering, had more than $100 million in annualized revenue.

Microsoft said its "commercial cloud," which entails Azure, Office 365, Dynamics 365 and other cloud services, had $6 billion in revenue in the fiscal third quarter, up 58 percent year over year and up 13 percent sequentially.

There were 30.6 million Office 365 consumer subscribers in the quarter, up sequentially from 29.2 million. On the Office 365 commercial side, revenue grew 42 percent. The Xbox Live gaming service had 59 million users.

Microsofts Dynamics 365 revenue increased 65 percent, while LinkedIn revenue grew 37 percent, and Surface revenue rose 32 percent.

The company reported $3.5 billion in capital expenditures, its highest level yet and up 66 percent year over year.

Microsoft stock is up 10 percent since the beginning of 2018.

- CNBCs Josh Lipton contributed to this story.