字體:小 中 大

字體:小 中 大 |

|

|

|

| 2018/03/07 22:03:49瀏覽71|回應0|推薦0 | |

China’s economyPoor by definitionChina’s government offers relief to the poor and to the economyDec 3rd 2011 | HONG KONG | from the print edition SINCE 1978 China has liberated more people from poverty than any other country in history, partly because China before 1978 consigned more people to poverty than anywhere else in history. But this week China added over 100m to the ranks of the poor. This was not the result of some economic calamity, but of the government’s welcome decision to relax its definition of rural poverty. About 128m Chinese countryfolk earning less than 2,300 yuan ($361) a year will now be deemed poor, compared with the 26.9m who fell beneath the previous poverty line of 1,196 yuan.

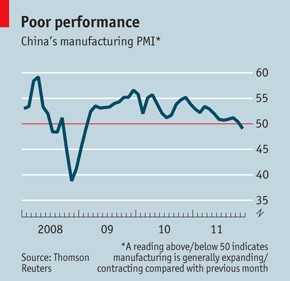

China has a tradition of defining destitution abstemiously, perhaps in an effort to keep the poverty count low and the relief bill down. But this week’s decision raises China’s poverty line close to or even above the World Bank’s global standard of $1.25 per day. That standard is widely misunderstood. It is calculated not at market exchange rates, but at purchasing-power parity rates, which take account of the lower prices prevailing in poor countries. China’s new, higher line qualifies 100m more people for a variety of benefits. That is good news for China’s poor, and also good news for China’s slowing economy. An official measure of manufacturing activity, based on surveys of purchasing managers, dropped to 49 on December 1st, its lowest reading since January 2009 (see chart). Managers feel business worsened or stagnated in November, compared with the month before. In this section

Europe’s woes must account for much of this disappointment. The rest of the blame probablylies with the government’s efforts to fight inflation by tightening the supply of money and credit. For the past couple of months it has been “fine-tuning” this policy, easing up on some things, but not on others. On November 30th it opted for something more dramatic, cutting the amounts that banks must keep in reserve at the central bank by 0.5 percentage points. That should ease the credit crunch that hurt many businesses over the summer. The fear, however, is that freeing the banks could lead to a lending spree like the one that rescued China from the previous crisis. That lending saddled many local governments with debts they are struggling to repay. These loans will be rolled over once, according to reports. But if local governments still need a bail-out after that, they will have to cede some of their budgetary freedoms to Beijing. That is how fiscal federalism works—as Europe is about to discover. If China’s slowdown remains modest, the government may get away with modest monetary measures: loosening the reins on the banks, without letting go. But if the economy deteriorates sharply, the government may lean more heavily on fiscal remedies. The central government is flush with cash, taking in 28% more in revenue this year than over the same period last year. And excessive lending to the banks’ traditional borrowers (state-owned enterprises and local governments) will help the economy less than extra spending on neglected constituencies, such as the 128m rural poor. If China is worried about the economic winter ahead, it should fatten up its skeletal welfare programmes, not its bloated banking system. from the print edition | Asia

Poor by definition Dec 5th 2011, 17:59

For Beijing, this dragon, the biggest issue or dilemma is to keep control on China’s economy resulting in the occurrence of either hard-landing or soft-landing, as the Economist reported in Octobor. Unavoidably, according to the more emerging essay in acedemic, about 2016-2017 China’s economy might face the growth percentage of GDP which would not be able to reach “7” this number due to the transformation of industrial and commercial style with the adjustment in banking system and currency against U.S. Dollar.

The indicator to decide whether hard- or soft- landing is that before China’s GDP can chase and meet the target of USD. 16740 (in 2005 measure) this dragon still hold the 7% high economic growth. In other words, in ten years there is a critical point of death cross previewing the dragon’s splendidly economic growth. Of course, the longer years the high growth will be lasting for, the better economic structure China can build also for the massive Chinese living under the poverty line. If this dragon cannot reach this number before the GDP growth is less than 7%, we call it the occurrence of hard-landing.

We can see the previous example for this critical point and the advanced discussion. The typical examples of occurrence, compared with China’s possibility in the upcoming ten years, are Japan, South Korea and Taiwan seperately in 1974, 1996 and 1997. These three had the similar experience when it comes to respectively appearent characteristic. All of these three accompanied one leading enterpreneurs, the embarassment of rich-poor discrepency and two-party evolution in politics.

Also, China inevitably may face these three concerns in the near future. Japan recovered herself after World War II with SONY’s Wada Kovo and South Korea rushed into the wealthy power with Samsung’s Lee Kun-Hee while Taiwan Hon-Hai’s Guo Tai-Min owned the fame in world industry, a mirror of Taiwan economic miracle. In this way, Sany’s Liang Wen-Gun about mechanical engineering or Hun-Da Property’s Hsu Jia-Ying are already the leaders of China’s economy exceeding more and more Chinese expectations. The evolution of these three economy has so many lessons China can learn from, mainly about massive economy. These examples includes Japan’s 1990s bubble economy bringing about Heisei Recession, Koizumi Junichiro’s structral reform, and Yukio Hatoyama’s Fabianist social welfare, South Korea’s mechanism of centralised policy’s formation and Taiwan’s adjustment method by Taipei’s central bank such as Nation’s Security Fund.

In addition, as this essay talked about the solution to China’s increasing people under poverty line, Beijing redefined the poverty and seriously figured out how to narrow the gap between the rich and the poor. Traditionally, Beijing is used to steering the wheel of massive economy by taking the measure to ensure the high growth from the order or policy about “open” this word. Another way is to have a meeting, usually gathering the professionals and business leaders, from very big Ba San-Ron Meeting to the numerous and nonsensus tea chats. Both often get the conclusion of transient solution on various problems.

Beijing used to give money to protect the poor from the unfortunate or order the poor to move houses and works. In recent month, starting from Shang Fu-Lin’s promotion about one month ago for Chinese Communist Party’s alteration of generation, Beijing takes the step towards the reflection of system and law. Meanwhile, the discussion of lending chain is working, especially the worsen “loan shark” concerned; for example, officials from the People’s Bank of China discussed property-market trends and financial-risk management at a meeting on Nov. 24 with the country’s banking regulator, representatives from 10 commercial lenders and university academics, according to a statement posted to the central bank’s website several days ago. Extending the exercising policy in this past one year from spring to winter, this dragon should pay attention to balancing individual thoughts and the whole structure, or say so-called micro- and macro- economy. Although keeping the balance is very arduous for this dragon, for being the strongest power in the world this dragon has a long way to go.

Recommended 12 Report Permalink

這裡第二段強調了一次$16740-7% death cross的論點,及提及台日韓三區都有適時相對稱的企業主上進的故事,之後數年筆者些許會再深入提及。1974、1996和1997年是日本、南韓和台灣人均超越這數字的時候,當時落在年成長率有6.5-7%不等處,在這之前這三個地區一直擁有大部份7以上甚至兩位數成長過。巴山輪會議至今仍有深遠意義,數年後經濟學人雜誌再刊出此會議重要乙次,很配服當年共黨的開明及遠瞻。舉了台北國安基金護盤的例子來稍比喻中國政府也應該會和亞洲四小龍的幾十年市場經濟政策,有些方面還是會借鏡。筆者當時透過在這討論區慢慢聊天要一年了,也瞭解讀者及作者群的用心,也適時在台灣紓發被壓抑的情緒。這時筆者(一度地)不太認得台灣了。

原文是說明按照國際上新定義$361,多了一億貧困人口。此後習近平上任後五年來,每年都會重視貧困線和縣的訪視,不過近日來這方面的成效還是很令人懷疑。 |

|

| ( 心情隨筆|心情日記 ) |