時代周刊:不要搞錯 ,「中國十年」才剛開始

文 / 程俊 2015年08月23日 (華爾街見聞 wallstreetcn.com)

股市下跌、貨幣貶值、經濟數據疲軟在整個夏季構成了有關中國經濟大頭條的一切。各種負面和悲觀的言論在市場蔓延。然而美國《時代周刊》文章卻認為屬於「中國的十年」已經開始,中國影響力的崛起勢不可擋。

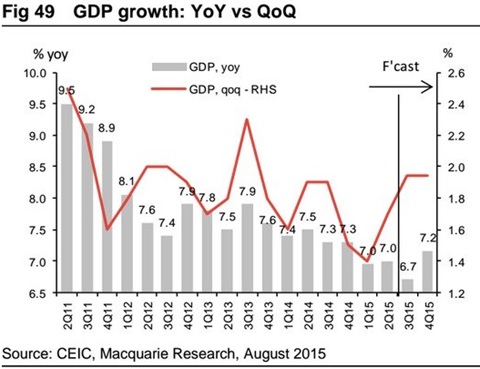

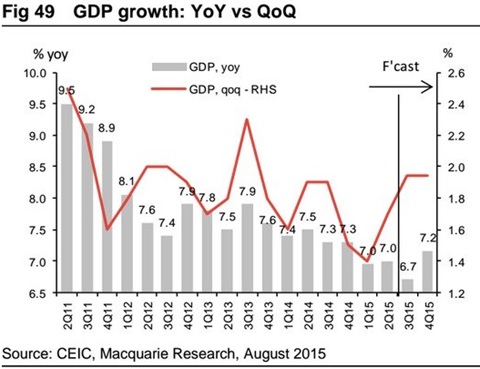

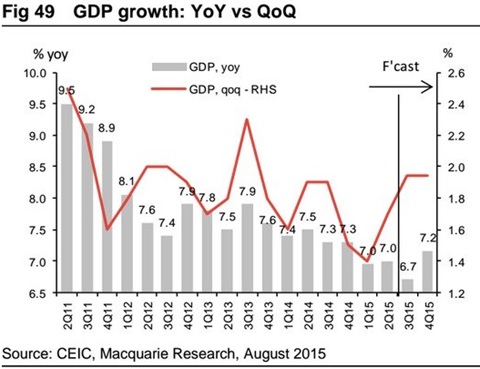

Group總裁 Ian Bremmer表示,首先從經濟數據來看,盡管GDP增速放緩已經是不爭的事實。但是同樣不可否認的是,和發達國家相比,中國的經濟增速依然十分具有優勢。而在新興市場國家全面遭遇挫折的情況下,中國目前的狀況談不上有多麼悲觀。

根據購買力平價(PPP)計算,2014年中國占全球GDP比例為16.32%,已經超過了美國的16.14%。而此前國際貨幣基金組織的報告也顯示,以購買力平價計算,美國2014年經濟規模為17.4萬億美元,而中國則達到了17.6萬億美元。按照IMF的最新估計,中國在2019年的PPP經濟規模將是美國的1.2倍。

而近期被人詬病的進出口數據來看,雖然短期似乎下滑明顯,但是從一個發展的眼光來看,向好的趨勢並沒有終結。

在2000年的時候,中國進出口僅占到全球貿易的3%,2014年這一比例已經上升到了10%。而在這十多年間,進出口數據的起伏也從來不是一馬平川。

2006年美國還是世界上127個國家和地區的主要貿易伙伴,而中國只是70個國家和地區的主要貿易伙伴。到了2011年,中美兩國位置幾乎互換,中國已經成為124個國家和地區的主要貿易伙伴,而美國則是76個國家和地區的主要貿易伙伴。

Bremmer進一步指出,雖然近期資本外流等狀況較為明顯,但是中國過去數十年間積累的外彙儲備十分豐厚。最新數據顯示,在連續數月流出的情況下,中國外儲的規模依然接近3.7萬億美元。放眼全球,這一規模也是最大的。

此外,政治穩定同樣是Bremmer看好中國的因素之一。Bremmer認為習近平主席的反腐大動作和其他一系列行動都將重塑市場信心,改革之路開弓沒有回頭箭。

第三個令Bremmer對中國未來充滿信心的理由則是中國過去二十年的「走出去」戰略。數據顯示,和2008年的70億美元相比,中國在非洲的投資規模在2013年已經飆升到了260億美元。在拉丁美洲,未來中國將投資2500億美元。這一切在Bremmer看來不僅將幫助中國獲得發展所迫切需要的自然資源,而且也將令中國的觸角影響更為廣泛更為強勁。

拉美國家發展所需要的公路、鐵路和機場將給中國帶來大量的就業機會。而在產能過剩的情況下,這些國家也為中國帶來了新的市場需求。

亞投行的建立則預示著中國構建全球新金融體系的決心。雖然美國及其「盟友」並未加入亞投行,但是亞投行的成員國依然達到了57個國家,並覆蓋了大多數主要經濟體。和亞洲開發銀行類似,亞投行在未來幾年的任務將是扶持區域基礎設施建設,這同樣和中國的戰略吻合。

當然,Bremmer同樣沒有忽視中國的長期挑戰。按照目前的速度,到2050年中國勞動力數量或將下降17%。就和體育明星退役之後一樣,老年人將需要更多的資金,而強勁的生成力也將難阻下滑之勢。

另外一個值得擔憂的問題則是環境污染。在中國500個城市中,僅有不到1%的比例能夠達到世界衛生組織的空氣標准需求。如何解決環境治理問題,中國政府已經開始了反思,但是結果如何還有待觀察。

無論如何,中國力量的增強正在構建世界新格局。中國的成功或者失敗都將對整個世界產生深遠的影響。

=====================================================

Make no mistake — this is the opening of the 'China Decade'

Ian Bremmer, TIME.com, Aug. 22, 2015

Stock market plunges, currency devaluations, and warehouse fireballs out of China have dominated headlines this summer.

China is still on the rise.

But make no mistake — this is the opening of the “China Decade,” the moment when the emerging giant’s international influence crosses a crucial threshold.

These five facts explain why China’s rise is inevitable, even in the face of bad news — and why it won’t last forever.

1. Rough summer

Economic indicators have been pointing to a Chinese slowdown for some time — exports had already dropped 8% last month compared to the same time last year — but matters have come to a head these last couple of months. Between June 12 and July 8, the Shanghai stock market plummeted 32%. On July 27, the stock market fell 8.5%, its greatest single-day drop. To put that in perspective, ??Black Tuesday,?? which kicked off the Great Depression in 1929, saw the Dow plunge 12%. Markets under the thumb of autocratic regimes were thought to be immune to such wild swings; turns out they’re not.

On August 11, the Chinese government devalued the renminbi to kick-start their slowing economy. By the end of the week, the currency’s value had fallen by 4.4%, its biggest drop in 20 years.

2. China’s rise

Yes, growth is slowing, but to levels enviable in any developed country. In the mean time, China’s march to No. 1 continues. In 2014, China’s total GDP overtook the US’s when measured by purchasing power parity. Using this metric, China accounted for 16.32% of world GDP in 2014, eclipsing the US’s 16.14%.

More impressive than the size of China’s economy is the speed with which it’s grown. Back in 2000, Chinese imports and exports accounted for 3% of all global goods traded.

By 2014, that figure had jumped to more than 10%. In 2006, the US was a larger trade partner than China for 127 countries. China was the larger partner for just 70. Today, those numbers have reversed: 124 countries trade more with China than with the US.

3. China’s resilience

And despite recent turmoil, China’s economy has staying power. That’s in part because China’s leadership has spent decades building its foreign-exchange reserves, which today are valued at $3.7 trillion. That’s by far the world’s biggest rainy-day fund.

More important than its money buffer is China’s consolidated political leadership under Xi Jinping. China’s president has presided over an extensive anticorruption campaign that has already seen 414,000 officials disciplined and another 200,000 indicted.

In the process, Xi has probably rebuilt some of the party’s lost credibility with China’s people. He has definitely sidelined current and potential opponents of his reform program — and of his rule. And the lack of backlash illustrates just how strong his political control really is.

4. Spreading wealth (and influence)

Consolidated leadership also enables Beijing to pursue its comprehensive global strategy. China has spent the last two decades tactically investing around the world. Chinese investments in Africa jumped from $7 billion in 2008 to $26 billion in 2013, helping the continent build desperately needed roads, rails, and ports.

In Latin America, China has already pledged to invest $250 billion over the coming decade, giving Beijing a solid foothold in the West. This extends China’s influence well beyond East Asia, helps China secure long-term supplies of the commodities it needs to continue to power its economy, creates jobs for Chinese workers, and helps China open new markets for its excess supplies of industrial products.

REUTERS/Jairo Cajina/Presidential Palace Nicaragua/Handout via ReutersNicaragua's President Daniel Ortega, left, and Wang Jing, chairman of the Hong Kong international company Nicaragua Canal Development Investment Co. (HKND Group) celebrate signing a concession agreement for the construction of an interoceanic canal in Nicaragua at the Casa de los Pueblos in Managua June 14, 2013.

China also wants to use its money to reshape the world’s financial architecture. To that end, Beijing just launched the Asian Infrastructure Investment Bank to rival the Washington-based IMF and World Bank. Given that 57 countries have signed up as founding members, some of them US allies who chose to ignore US objections, it’s well on its way. With initiatives like the AIIB, China will continue funding infrastructure projects — and building goodwill — for years to come.

5. Problems ahead

All that said, China’s longer-term challenges are becoming impossible to ignore. By 2050, it’s estimated that China’s work force will have shrunk by 17%. Blame demographics — back in 1980, the median age in China was 22.1 years; in 2013, 35.4, and by 2050 it will rise to 46.3. An aging labor force is like an aging sports star: Both want more money, and both are nowhere near as productive as they once were.

Pollution continues to take its toll — less than 1% of China’s 500 cities meet WHO air-quality standards. China’s environment ministry concedes that nearly two-thirds of underground water and one-third of surface water is "unfit for human contact." A new study estimated that 4,000 Chinese die prematurely each day thanks to air pollution.

REUTERS/David Gray A man swims in a polluted canal in the center of Beijing, August 16, 2007.

As China’s masses join a growing middle class, the leadership will have to deal with stronger public demand for clean air and water. Beijing better deliver if it wants to keep the peace, and its regime, intact.

And the public will have the means to make its demands known: There are already 650 million Chinese people online, and censorship, however sophisticated, can never fully control the flow of ideas and information in a social-media market of that scale — witness the information leaking out on the Tianjin blast. China’s leaders know they must care about public opinion.

China’s growing strength threatens the established world order, but its domestic vulnerabilities will have global repercussions, as well. It’s still too early to tell which of the two will be more destabilizing.

Either way, the world will be shaped by Beijing’s successes and its failures.

字體:小 中 大

字體:小 中 大